The Scandinavian-based Ethiopian gold exploration and mining company has today released an improved gold production mine plan for its first 12 months of mining operations in the Eastern and Western winzes (tunnels). The updated plan improves the current production schedule and will have a significant effect on the initial revenue and EBITDA from the Segele mine. Most of the improvements will come in the first part of production.

Table 1: Comparison to previously released revenue and EBITDA estimates

|

|

Updated version |

Previous version* |

Difference |

|

12 months revenue** |

39,0 mUSD |

29,4 mUSD |

9,6 mUSD |

|

12 months EBITDA |

28,8 mUSD |

20,0 mUSD |

8,8 mUSD |

* Source: 27 Feb 2024. Press release: Agreement on debt restructuring, Private Placement successfully completed, announcement of rights issue and proposed conversion of unsecured debt

** Gold price estimate of 1950 USD per ounce

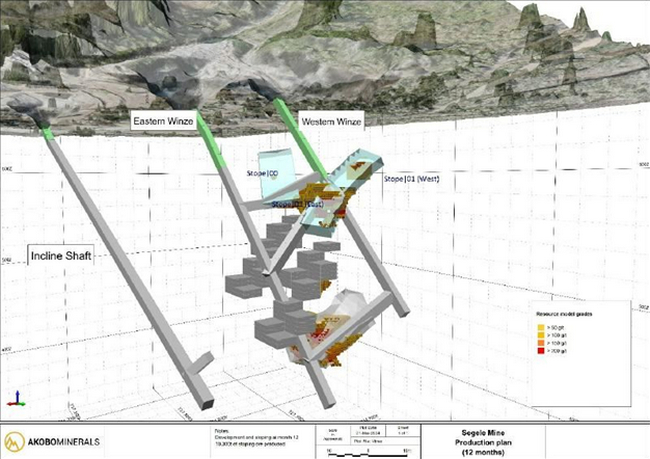

Following from the advanced operational understanding developed over the last few months of owner operator mining and hiring of a Mine Planner, the company has revised its mine plan and estimations for the first 12 months of gold production. Due to the specific nature of the Segele ore body, the mining will focus on developing stopes (pockets) targeting the high-grade gold areas of the ore body first. The very first Stope 00 developed will be a trial stope in an area that is not explored, before moving into the identified gold rich ore body. The trial stope will give valuable information and experience regarding geology, stope practice and feed to commission the plant. The next Stope 01 is then expected to be one of the best stopes in the life of the mine.

The mine plan primarily focuses of the upper part of the resource and the first 12 months of production. Future optimisation will extend this plan and recover more gold. The optimised part of the mine plan indicates a recovery of 77 % with potential upside. The following assumptions have been used:

- 50 % of crosscuts counted as ore with a grade of 22.7 g/t

- No ore recovery from winzes and incline shaft (Upside)

- No pillar drawing/pillar robbing at the end of LOM (upside)

- No use of backfill to recover barrier pillars (upside)

Table 2: Details of initial stope-groups to be mined, representing next 12 months of production. Showing gold endowment from Segele SRK Mineral Resource Estimate*

|

Stope group no. |

Avg. grade |

Tonnage |

Ounces |

Classification** |

|

1 (group) |

74.61 g/t |

4,272 t |

10,248 oz |

Indicated mineral resource estimate |

|

2 (group) |

43.78 g/t |

6,167 t |

8,680 oz |

Indicated mineral resource estimate |

|

3 (group) |

15.99 g/t |

5,203 t |

2,676 oz |

Indicated mineral resource estimate |

* Mineral Resource Estimate of 94ktons at an average grade of 22.7g/t and totally 69k ounces. The Mineral Resources are reported above a 2.65g/t Au cut off (22 April 2022)

** Source: 22nd April 2022. Press release: Akobo Minerals reports significant gold mineral resource increase and classification upgrade which underpins strong mine economics.

The updated mine plan uses the SRK Mineral resource model as it’s basis. The production schedule is adjusted according to the actual mine development plan.

Early production plan for Western and Eastern Winzes (Stope group 1 and 2 from Table 2). High grades areas indicated.

In conclusion, while we acknowledge the ongoing challenges in our operational environment that have created significant delays, including procurement and logistics issues, we want to assure our stakeholders that we are fully committed to addressing these obstacles. Though uncertainties still persist and may impact our future progress, we remain focused on diligently working through these challenges day by day, with the aim of achieving our production goals.

About Akobo Minerals

Akobo Minerals is a Scandinavian-based gold exploration and boutique mining company, currently holding an exploration license covering 182 km2 and a mining license covering 16 km2 in the Gambela region and Dima Woreda, Ethiopia. The company has established itself as the leading gold exploration company in Ethiopia through more than 13 years of on-the-ground activity, which has now been enhanced further with the development of its Segele mine.

Akobo Minerals’ Segele mine has an Inferred and Indicated Mineral Resource of 68,000 ounces, yielding a world-class gold grade of 22.7 g/ton. Still open to depth, the gold mineralised zone continues to expand and will have a positive impact on future resource estimates and the life expectancy of the mine. The exploration license holds numerous promising exploration resource-building prospects in both the vicinity of Segele and in the wider license area.

Akobo Minerals has an excellent relationship with local communities all the way up to national authorities and the company places environment and social governance (ESG) at the heart of its activities – as demonstrated by a planned, industry-leading, extended shared value program.

Akobo Minerals has built a strong local foothold based on the principles of sound ethics, transparency and communication, and is ready to take on new opportunities and ventures as they arise. The company is uniquely positioned to become a major player in the future development of the very promising Ethiopian mining industry. The company is headquartered in Oslo and is publicly listed on the Euronext Growth Oslo Exchange and the Frankfurt Stock Exchange under the ticker symbol AKOBO. For US investors, Akobo Minerals AB (OTCQX: AKOBF) is traded on the OTCQX Best Market, adhering to high financial standards, best practice corporate governance, and compliance with U.S. securities laws. Additionally, the company has a professional third-party sponsor introduction, and investors can access current financial disclosures and Real-Time Level 2 quotes for the company on www.otcmarkets.com.

Akobo Minerals places great emphasis on meeting and exceeding industry standards, fully complying with all aspects of the JORC code, 2012. For detailed information on their adherence to this code, please refer to https://www.jorc.org/. Akobo Minerals' unwavering commitment to ethical practices, community engagement, and environmental responsibility positions them as a formidable force in the evolving landscape of the Ethiopian mining sector.