Displaying items by tag: globaldata

Evolving blockchain technology can transform diverse oil and gas applications, says GlobalData

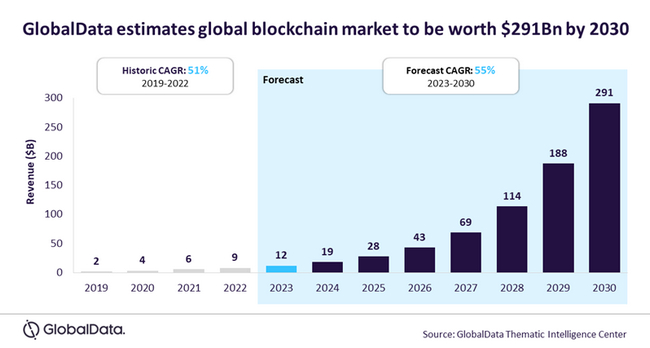

Blockchain is emerging as a technology that demands attention within the oil and gas sector. It presents novel approaches to service contracts, review pricing, and support the entirety of the transaction life cycle. It thus promises potential cost reductions and enhanced process efficiencies. Moreover, the advantages of blockchain in the oil and gas industry manifest through enhanced transparency, compliance, and data security, says GlobalData, a leading data and analytics company.

GlobalData’s thematic report, “Blockchain in Oil and Gas,” provides an overview of the blockchain technology and its potential implications in oil and gas operations. It also highlights the role of major oil and gas companies, such as ADNOC, BP, Eni, Equinor, Repsol, and Shell in the development of blockchain to address their challenges.

Ravindra Puranik, Oil and Gas Analyst at GlobalData, comments: “While the initial use focused on supply chain optimization, blockchain has evolved considerably in recent years to support transaction processing with smart contracts. Moreover, the establishment of consortiums has helped to standardize protocols and exchange best practices. With the maturation of the technology, its adoption is expected to expand, ushering in improved transparency, efficiency, and security in operations.”

Blockchain has a range of compelling applications within the oil and gas industry. It has the potential to accelerate digital transformation using sensors and cloud computing. The tokenization of physical assets has also emerged as a promising application.

Puranik continues: “Tokenization involves digitizing a tangible asset for managing big data or safeguarding sensitive information. It has the potential to streamline bureaucratic processes during the production, transportation of processing of a natural resource across various jurisdictions. A token can facilitate transparency in tracking the movement of natural resources throughout the developmental phases. This transparency not only highlights opportunities to minimize waste but also aids in identifying potential irregularities, thereby aiding the sector in fortifying its reputation at a time when it faces challenges from alternative energy sources.”

With the hype around blockchain subsiding, adoption is quietly increasing, focusing on practical benefits and efficiency gains rather than technological novelty. The realization that blockchain’s fit may not be universal, coupled with the importance of having a strong digital infrastructure in place, will continue to drive the trend toward meaningful implementation.

Puranik concludes: “As sensor technology reaches its peak within the industry amid rising adoption of the Internet of Things (IoT), blockchain facilitates the direct storage of transactions and accounting data on these devices. By linking assets directly to service contracts, blockchain significantly diminishes processing time and fundamentally alters contracting by providing secure collaboration. Although adoption is currently in its early stages, the potential of blockchain in the oil and gas sector is poised for substantial growth as companies recognize its full capabilities.”

- Quotes provided by Ravindra Puranik, Oil & Gas Analyst at GlobalData

- Information based on GlobalData’s thematic report: Blockchain in Oil and Gas

- This press release was written using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

Oil and gas industry shows resilience amid 16% QoQ decline in overall contract volume during Q4 2023, reveals GlobalData

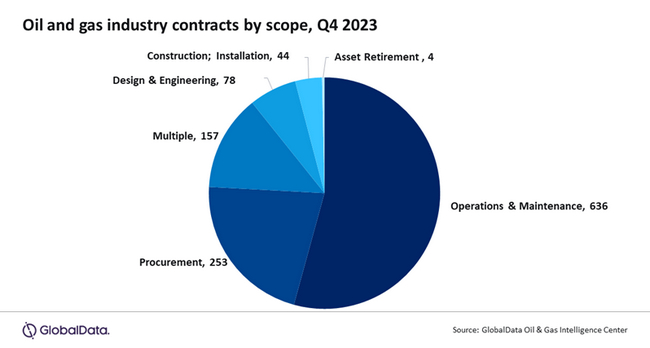

Amidst shifting market dynamics, the oil and gas industry faced a significant quarter-on-quarter (QoQ) decline of 16% in disclosed contract volume from 1,401 in Q3 2023 to 1,172 in Q4 2023. However, despite this downturn, a marginal uptick in overall contract value hints at resilience during the challenging times, reveals GlobalData, a leading data and analytics company.

GlobalData’s latest report, "Oil and Gas Industry Contracts Review by Sector, Region, Terrain, Planned and Awarded Contracts and Top Contractors and Issuers, Q4 2023,” reveals that the overall contract value marginally increased from $46 billion in Q3 2023 to $48 billion in Q4 2023.

Pritam Kad, Oil and Gas Analyst at GlobalData, comments: “The significant contract value in the quarter was largely driven by Tecnimont, Saipem, and NPCC's significant contracts with ADNOC totaling $8.7 billion and $8.2 billion, respectively, for the Hail and Ghasha Development Project in Abu Dhabi, the UAE. These contracts were pivotal in elevating the oil and gas contracts landscape, potentially boosting opportunities for further growth and collaboration in the region.”

Operation and Maintenance (O&M) represented 54% of the total contracts in Q4 2023, followed by procurement scope with 22%, and contracts with multiple scopes, such as construction, design and engineering, installation, O&M, and procurement, which accounted for 13%

ADNOC's contracts with Tecnimont, Saipem, and NPCC involve significant responsibilities. Tecnimont will oversee the construction of an onshore processing plant, including gas processing units, sulphur recovery sections, utilities, offsites, and export pipelines. Saipem and NPCC, on the other hand, will handle the Engineering, Procurement, and Construction (EPC) of drilling centers, processing plants, and various offshore structures on artificial islands for the Hail and Ghasha Development Project.

Additionally, in the petrochemical sector, notable contract being SGC eTEC E&C’s EPC contract from Sipchem and Tasnee for the expansion of an ethylene cracker plant in Al-Jubail, Saudi Arabia.

Kad concludes: “Despite facing challenges in the market environment, the oil and gas industry has demonstrated resilience. This is evident from the slight increase in total contract value, despite a significant drop in disclosed contract volume. Looking ahead, it is imperative for the industry to prioritize strategic investments and forge partnerships to navigate uncertainties and foster sustainable growth.”

- Quotes provided by Pritam Kad, Oil & Gas Analyst at GlobalData

- Data taken from GlobalData’s latest report: Oil and Gas Industry Contracts Review by Sector, Region, Terrain, Planned and Awarded Contracts and Top Contractors and Issuers, Q4 2023

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

Plastic straw ban will have disruptive, albeit short-term impact on India soft drinks industry, says GlobalData

India is all set to ban the production, import, stocking, distribution, sales, and use of an array of single-use plastic products including straws. Against this backdrop, the ban on plastic straws will temporarily disrupt the sales of small packs of soft drinks, which are very popular among the Indian masses, opines GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Market Analyzers* reveals that the margins on small packs in India are low as they typically retail at INR10–INR30 ($0.13– 0.38). Nonetheless, owing to their mass-market appeal, pack sizes of 100ml to 330ml contributed 35.1% of overall soft drinks volumes in 2021. However, as the ban extends to plastic straws, which are quintessential accessories for small packs, soft drinks companies will be badly hit.

Bobby Verghese, the Consumer Analyst at GlobalData, comments: “Plastic straws are a part and parcel of the consumption experience of small cartons and pouches packs. Switching to bottles, cups, or pack formats with drinking spouts is a cost- and time-intensive proposition for soft drinks companies. In addition, the domestic manufacturing capacity for recyclable, biodegradable, and edible straws may prove insufficient in time for the ban. Moreover, the high import cost of such sustainable straws will drive up prices of the small packs at the cost of its mass-market appeal.”

Leading companies such as Parle Agro, Amul, and Dabur are developing in-house capacity for paper straws, and others are expected to toe the line sooner or later. On a positive note, the Indian Paper Manufacturers Association has affirmed that domestic paper mills are capable of producing sufficient paper straws for the soft drinks industry.

Verghese concludes: “While single-use plastic pollution is a growing concern for Indian authorities and consumers, the price-sensitive masses are unable to foot the bill for eco-friendly alternatives. The onus is therefore on the industry to adopt sustainable packaging and take accountability for the packaging waste.

“While the change is painful, in the long-term companies can gain consumer goodwill given that sustainable/environmentally friendly feature is an essential factor for 56% of Indian consumers while purchasing products, according to GlobalData’s 2022 consumer survey**.”

- Quotes provided by Bobby Verghese, the Consumer Analyst at GlobalData

- Data is taken from GlobalData Consumer Intelligence Center—Market Analyzers, accessed in June 2022 and GlobalData 2022 Q2 Consumer Survey—India, with 598 respondents, published in June 2022

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis, and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology, and professional services sectors.

180,000 bugs in every fully autonomous vehicle are like an open door to cyber criminals, says GlobalData

Many autonomous vehicles are not fully protected against cyberattacks, with GlobalData, a leading data and analytics company, estimating that there may be up to 180,000 bugs in the code operating a level 5 autonomous vehicle*— potentially leaving hackers with 15,000 security vulnerabilities to choose from.

GlobalData’s latest report, ‘Cybersecurity in Automotive – Thematic Research’, stresses the importance of defending all of the infrastructures upon which connected cars rely, noting that we are entering a ‘Code War’ era, where every digital device—no matter how small—can be weaponized.

Emilio Campa, Analyst on the Thematic Research team at GlobalData, comments: “Autonomous vehicle manufacturers may be making sure the physical doors lock, but as it stands, the digital doors are wide open. Over the past decade, hackers have accessed the vehicles of numerous major brands: remotely unlocking doors, collecting sensitive data, and even taking control of vehicles. This just isn’t good enough, and autonomous vehicles won’t be safe enough until these gaps are plugged.”

Automotive businesses are increasingly talking about cybersecurity in their financial reports, according to GlobalData’s Company Filing Analytics. The number of mentions of ‘cybersecurity’ expanded almost fourfold between 2016 and 2021. However, the number of mentions is relatively small when compared to other major themes in the sector—especially environmental, social, and governance (ESG) issues. In 2021, the number of mentions of ‘ESG’ was over 20 times bigger than the number of ‘cybersecurity’ mentions.

Campa continues: “Cybersecurity is competing for attention with other major issues such as ESG and geopolitics. While these are also pressing matters, the importance of comprehensive cybersecurity in automotive cannot be overstated. Public safety aside, cyber breaches and cyberattacks directly affect the value and integrity of car manufacturers’ brands. New vulnerabilities are also constantly coming to light, and they can be difficult to fix.”

Cybersecurity-related regulation is being implemented in different ways around the world. The UN Economic Commission for Europe (UNECE) Regulation 155 comes into force in July 2022, the ISO/SAE 21434 standard has been developed, and countries from the US to China are adopting local regulations and oversight. As a result, auto players must be aware of the regulatory landscape to ensure compliance.

Campa adds: “There is a real requirement for manufacturers to get up to speed on cybersecurity, and to do so quickly. The auto industry will face more cyberattacks as it introduces more connected, digital, and electronic systems to new vehicles and as companies themselves become more digital. With cyberattacks causing severe reputational damage and being expensive to remediate, automotive cybersecurity cannot be ignored.”

- Level 5 autonomous vehicles are fully self-driving vehicles that can handle all driving tasks in all circumstances. These vehicles probably won't feature human controls and must be able to safely handle any situation they might encounter.

Quotes provided by Emilio Campa, Analyst on the Thematic Research team at GlobalData

GlobalData’s latest report, ‘Cybersecurity in Automotive – Thematic Research’, provides an invaluable guide to this extremely disruptive theme. It includes comprehensive lists of the leading players across all aspects of the cybersecurity value chain, helping companies identify the right partners.

The report also includes a guide to the major challenges the automotive industry is facing and how they impact the need for comprehensive cybersecurity in vehicles.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

China to lead Asia’s refinery CDU capacity additions through 2026, says GlobalData

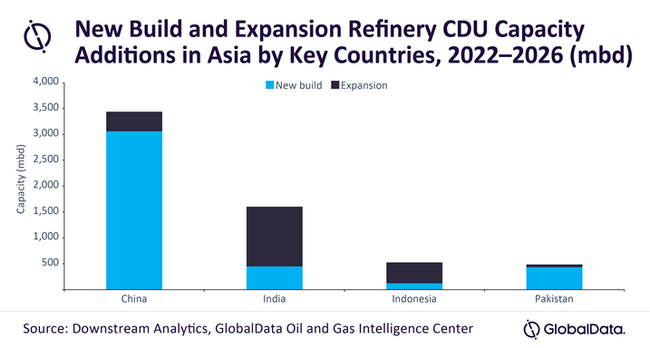

Asia is expected to witness the highest crude distillation unit (CDU) capacity additions globally contributing about 47% of the total CDU capacity additions by 2026, according to GlobalData, a leading data and analytics company.

GlobalData’s report, ‘Refining Industry Market Installed Capacity and Capital Expenditure (CapEx) Forecast by Region and Countries including details of All Active Plants, Planned and Announced Projects, 2022-2026’, reveals that Asia is likely to witness a total CDU capacity addition of 7.1 million barrels per day (mmbd) by 2026. Of this, new build capacity would be 4.3 mmbd while the rest is from expansion of existing refineries.

Teja Pappoppula, Oil and Gas Analyst at GlobalData, comments: “China and India primarily drive refinery CDU capacity additions in Asia by 2026. Yulong and Jieyang, both in China, are the largest upcoming new-build projects in Asia during 2022 to 2026 outlook period, each with a capacity of 400 thousand barrels per day (mbd). Among the expansion projects, Vadinar in India is expected to witness the highest capacity additions of 515 mbd by 2026 in the region.”

GlobalData identifies the Africa as the second highest contributor to the global CDU capacity additions accounting for about 22% of the total additions by 2026. New build projects contribute to almost entire capacity additions in the region with Lagos I refinery in Nigeria leading the way with a capacity of 650 mbd by 2026. The major expansion project in the region is the Assiut I refinery in Egypt. It is expected to start operations in 2024 with a capacity of 100 mbd.

Middle East ranks third globally contributing about 19% of world’s CDU capacity additions during the outlook period 2022–2026. Al-Zour in Kuwait drives the new build CDU capacity additions in the region with 615 mbd by 2026. Ruwais in United Arab Emirates and Isfahan in Iran drive the expansion capacity additions with 200 mbd and 120 mbd, respectively.

- Comments provided by Teja Pappoppula, Oil & Gas Analyst at GlobalData

- Information based on GlobalData’s report: ‘Refining Industry Market Installed Capacity and Capital Expenditure (CapEx) Forecast by Region and Countries including details of All Active Plants, Planned and Announced Projects, 2022-2026’

- New build: Denotes only assets/projects that are in different stages of development and have not started commercial operations

- Expansion – Denotes capacity expansion of a unit(s) in an existing refinery

- This report was built using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis, and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.

Leading oil and gas companies are tapping into digital technologies to improve productivity and profitability, says GlobalData

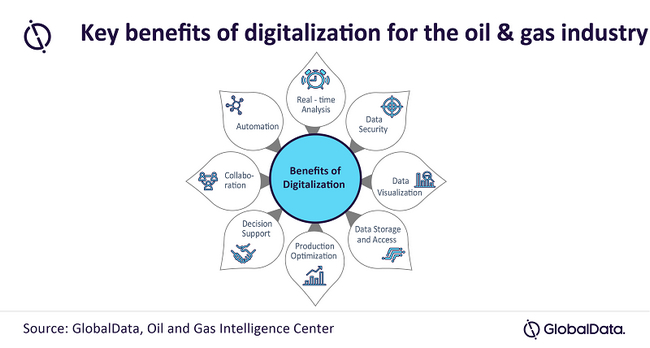

Digitalization, which involves the adoption of digital technologies such as artificial intelligence (AI), big data, cloud computing, cybersecurity, the Internet of Things (IoT), and robotics in day-to-day oil and gas operations, is enabling the industry to improve productivity and profitability by streamlining operations and cutting costs, says GlobalData, a leading data and analytics company.

According to GlobalData’s report, ‘Digitalization in Oil and Gas – Thematic Research’, digital technologies can deliver actionable insights for an oil and gas asset and help companies to reduce their capital and operating expenditures.

Ravindra Puranik, Oil and Gas Analyst at GlobalData, comments: “The adoption of digital technologies in the oil and gas industry has been previously hindered by the shortage of skilled technicians, concerns over data security, and cost-benefit uncertainty for adapting aging assets. However, since the technologies have the ability to transform the industry and create a synchronized ecosystem to meet future energy demands, an increasing number of oil and gas companies are upgrading their assets with digital technologies for long-term gains.

“Minimizing equipment downtime while enhancing operational performance remain key focus areas for increasing company revenues. There is also a growing emphasis among producers on digitalizing workflows to enhance operational visibility for improved decision making.”

Leading oil and gas players are increasingly collaborating with technology vendors in a bid to develop custom digital solutions that address their needs. For instance, TotalEnergies has collaborated with IBM to develop predictive drilling analytics to aid precision drilling. Similarly, Equinor has developed and deployed its digital twin, Echo, in its North Sea operations by leveraging its exploration and production (E&P) expertise in the region. Concepts such as digital twins and predictive maintenance are increasingly being modified to suit the different use cases of the oil and gas value chain.

Puranik concludes: “Digital technologies are improving the oil and gas industry by streamlining processes and creating new frontiers for operations. These technologies are well suited to tap new hydrocarbon deposits, boost operational efficiency, and reduce methane emissions.”

- Quotes provided by Ravindra Puranik, Oil & Gas Analyst at GlobalData

- Information based on GlobalData’s thematic report: ‘Digitalization in Oil and Gas – Thematic Research’

- This press release was written using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors. PR15654

Oil and gas majors look to carbon capture to diversify revenue streams after committing to 2050 net zero emission target, says GlobalData

As the energy transition heats up, many oil and gas companies have begun to recognize the writing on the wall and commit to net zero emissions by 2050 or sooner, according to GlobalData. Carbon capture, utilization, and storage (CCUS) is seen as a path for oil and gas companies to reach those targets while generating additional revenue, and to some degree as a necessary component of global decarbonization as well, observes the leading data and analytics company.

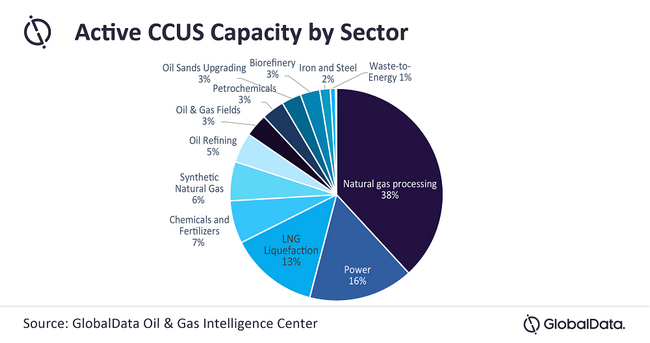

GlobalData’s latest report, ‘Carbon Capture, Utilisation and Storage (CCUS) Strategies in Oil and Gas Industry’, reveals that existing CCUS capacity is concentrated at natural gas processing plants due to the use of captured CO2 in Enhanced Oil Recovery (EOR) activities within the upstream segment of oil and gas. By 2030, all the largest CCUS sectors shown are expected to grow, but none faster than the power sector, which will become the largest user of CCUS capacity. Several oil & gas majors are already collaborating on CCUS projects in the power sector, demonstrating that these companies are beginning to diversify their revenue streams.

Miles Weinstein, Energy Transition Analyst at GlobalData, comments: “Many oil and gas companies developed CCUS knowhow by way of EOR projects simply to boost production, long before they were considering cutting emissions. Today, that knowledge has new value, as oil and gas companies have begun selling their CCUS knowledge in the form of technical advisory services or in developing their own emission reduction projects. Additionally, there is evidence that CCUS projects could generate large amounts of revenue through the growing carbon offset market. For example, Occidental Petroleum believes it could bring in more than $1.5 billion, more than its chemicals business makes today.”

Some of the most active companies GlobalData has identified in the CCUS sector are ExxonMobil, INEOS, TotalEnergies, Occidental Petroleum, Equinor, Shell, and Chevron. Some of these companies, like Exxon, have actively used CCUS technologies for EOR for several decades. Many likely see CCUS as a route to maintain oil and gas production while reducing emissions. While specific strategies vary by company, certain themes emerge. For example, a number of the aforementioned companies support carbon pricing as part of a stable regulatory regime surrounding decarbonization, and already set an internal, company-wide price on carbon for investment and planning purposes. By any measure, CCUS capacity will have to ramp up quickly before 2050 in order to see an impact on emissions reduction.

Weinstein explains: “While CCUS capacity is growing, existing capacity accounts for just 0.15% of total energy-related carbon emissions. According to new planned and announced capacity, this would increase to just 0.8% by 2030. CCUS remains an expensive technology to build or retrofit onto existing facilities, and widespread commercialization will require continued cost reductions. Fortunately, recent R&D efforts have been successful at improving capture technologies at low cost.”

Many large CCUS projects are found at industrial hubs and ports, where carbon can be captured from multiple facilities and fed into a shared transportation network for storage or utilization, leading to lower infrastructure costs. This collaborative approach leads to new partnerships between oil and gas companies, as well as companies in other sectors such as chemicals, power, or heavy industry, all working on the same project.

Weinstein adds: “The burgeoning CCUS sector serves as an example of how the oil and gas sector is beginning to be disrupted from the traditional model, despite serving as one of the least disruptive methods of emissions reduction because it maintains existing revenue streams and infrastructure. Thus, oil and gas companies have a vested interest in the commercialization and widespread use of this technology, as it serves as a bulwark to bigger changes.”

Comments provided by Miles Weinstein, Energy Transition Analyst at GlobalData

Information taken from the GlobalData report: CCUS Strategies in Oil and Gas

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors. PR15500

Global oil and gas contracts stifled in Q1 2022 as a result of rising inflation and the Russia-Ukraine conflict, says GlobalData

At the start of Q1 2022, global oil and gas industry contract activity was stifled due to the Russia-Ukraine conflict. However, in the second half of the quarter a minor increase in the number of contracts was reported. Unfortunately, the industry was unable to maintain its position in terms of contract value compared to the previous quarter, according to GlobalData, a leading data and analytics company.

Pritam Kad, Oil & Gas Analyst at GlobalData, comments: “Contracts in the oil and gas industry could only float due to the sheer uncertainties surrounding it, including the ongoing Russia-Ukraine crisis, rising prices, and project cost escalation. However, Saudi Aramco was able to keep the momentum going with Zuluf oil field expansion contracts during the quarter.”

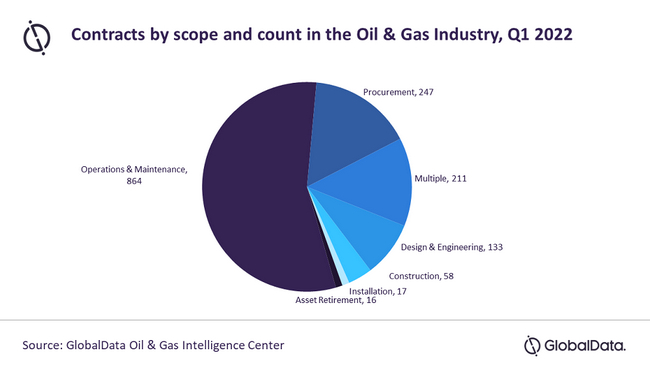

GlobalData’s latest report, ‘Q1 2022 Global Oil & Gas Industry Contracts Review’, reveals that the number of contracts saw a minor increase from 1,452 in Q4 2021 to 1,546 in Q1 2022. However, overall contract value decreased significantly from $61.16 billion in Q4 2021 to $36.93 billion in Q1 2022.

In terms of single scopes, operation and maintenance (O&M) represented 56% of the total contracts in Q4 2021, followed by procurement with 16%, and contracts with multiple scopes, such as construction, design and engineering, installation, procurement, and O&M accounted for 14%.

A notable contract during the quarter was Saudi Aramco’s award of multiple contracts for the expansion of the Zuluf oil field in Saudi Arabia, including EPC work to JGC Holdings ranging between $2 and $2.5 billion for two sets of oil and gas separation units, gas compression units, and onshore processing facilities such as crude oil processing units, as well as EPC for injection water pumps, water-oil separation units, thermal oil systems, electrical and non-electrical facilities;

Another notable contract would be those awarded to the National Petroleum Construction Company (NPCC) for construction work associated with the fourth and fifth Zuluf packages, where the fourth package CRPO 82 includes at least 12 oil-handling wellhead topsides, two oil tie-in platforms, and one electrical distribution platform, and the fifth package CRPO 83 includes up to 12 additional oil-handling wellhead topsides, two oil tie-in platforms, as well as infield pipelines and cables.

- Quotes provided by Pritam Kad, Oil & Gas Analyst at GlobalData

- Data taken from GlobalData’s Q1 2022 Global Oil & Gas Industry Contracts Review

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors. PR15640

India to lead Asia’s LNG regasification projects starts through 2026, finds GlobalData

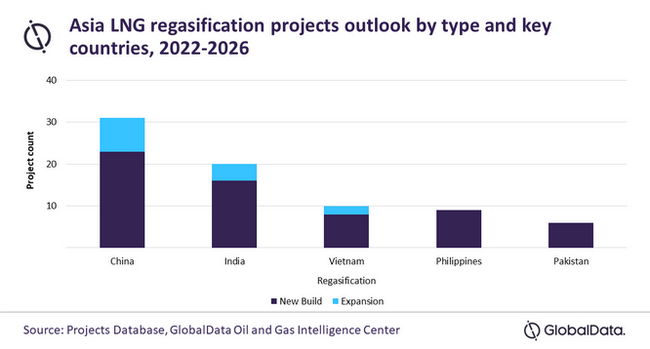

Asia is expected to lead the LNG regasification projects starts among the regions globally from 2022 to 2026. India is anticipated to be one of the primary countries to drive Asia’s LNG regasification projects count by 2026, contributing around 21% of projects starts, says GlobalData, a leading data and analytics company.

GlobalData’s latest report, ‘LNG New-Build and Expansion Projects Analytics and Forecast by Project Type, Sector, Countries, Development Stage, Capacity and Cost, 2022-2026’, reveals that India leads the region with the 20 LNG regasification projects with a total capacity of 3.4 tcf (trillion cubic feet) between 2022 and 2026. In India, about 40% of the upcoming regasification projects are likely to be in the approval stage and expected to start operations from 2022 to 2026. Feasibility and construction follow with 35% and 20% respectively.

Sudarshini Ennelli, Oil and Gas Analyst at GlobalData, comments: “In India, 16 upcoming regasification would be new-build projects while the rest are expansion projects. Growing demand from both industrial sectors and Indian government’s plans to increase gas share in energy mix to reduce emissions are driving the natural gas demand in India.”

Kakinada GBS Floating is the largest upcoming regasification project in India with 351 billion cubic feet (bcf) capacity expected to be operational by 2024. To be operated by Crown LNG, the project would especially serve the industrial consumers such as power and fertilizer plants in and around the Andhra Pradesh state.

Yanam is another major project regasification in India with a capacity of 268 bcf. Hindustan LNG is the operator of the project, which is currently awaiting approval and is expected to start operations by 2026. The project also aims to supply natural gas power plants in the Andhra Pradesh state.

- Comments provided by Sudarshini Ennelli, Oil & Gas Analyst at GlobalData

- Information based on GlobalData’s report: ‘LNG New-Build and Expansion Projects Analytics and Forecast by Project Type, Sector, Countries, Development Stage, Capacity and Cost, 2022-2026’

- Announced/Planned: Denotes only new-build assets that are in different stages of development and have not started commercial operations

- A new-build project that has not received relevant/ required approvals to develop/build the project is considered as Announced

- A new build project that has received relevant/ required approvals from the national government/ energy ministry/ regulatory authority/ local environmental authority/ port authority/local government, etc to develop/build the project is considered as Planned

- Expansion – Denotes capacity expansion of existing/operational terminal

- This report was built using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis, and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.

India to lead Asia liquids storage capacity growth through 2026, forecasts GlobalData

India is expected to lead the liquids storage capacity growth in Asia, contributing about 23% of the total capacity growth between 2022-26. The country is likely to add 23.9 million cubic meters (mmcm) of liquids storage capacity by 2026, forecasts GlobalData, a leading data and analytics company.

GlobalData’s report, ‘Global Liquids Storage Industry Outlook to 2026 – Capacity and Capital Expenditure Outlook with Details of All Operating and Planned Terminals’, reveals that Asia’s liquids storage capacity is expected to increase by 103.6 mmcm during 2022-2026. Out of the total capacity additions, 67.5 mmcm is likely to come from new build projects, and expansions of active projects contribute to the rest with 36.1 mmcm.

Teja Pappoppula, Oil and Gas Analyst at GlobalData, comments: “India is expected to account for the total liquids storage capacity additions of 23.9 mmcm by 2026. Of these, 19.5 mmcm is likely to come from new build projects and the rest 4.4 mmcm would be from expansion projects. Most of these capacity additions are being planned to meet ever growing demand for crude and petroleum products in the country.”

Teja Pappoppula, Oil and Gas Analyst at GlobalData, comments: “India is expected to account for the total liquids storage capacity additions of 23.9 mmcm by 2026. Of these, 19.5 mmcm is likely to come from new build projects and the rest 4.4 mmcm would be from expansion projects. Most of these capacity additions are being planned to meet ever growing demand for crude and petroleum products in the country.”

Among the new build projects, the planned Chandikhol liquids storage terminal will be the largest with a capacity of 4.8 mmcm and is expected to become operational in 2025.

The announced Bikaner liquids storage terminal stands next in India with capacity of 4.4 mmcm and is expected to be added in 2025.

The third highest contributor in the country is the planned Padur II terminal, which is likely to add a capacity of 2.9 mmcm in 2025. Indian Strategic Petroleum Reserves Ltd will be the operator of this liquids storage terminal.

- Comments provided by Teja Pappoppula – Oil & Gas Analyst at GlobalData

- Information based on GlobalData’s report: Global Liquids Storage Industry Outlook to 2026 – Capacity and Capital Expenditure Outlook with Details of All Operating and Planned Terminals

- This report was built using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis, and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.