As the energy transition heats up, many oil and gas companies have begun to recognize the writing on the wall and commit to net zero emissions by 2050 or sooner, according to GlobalData. Carbon capture, utilization, and storage (CCUS) is seen as a path for oil and gas companies to reach those targets while generating additional revenue, and to some degree as a necessary component of global decarbonization as well, observes the leading data and analytics company.

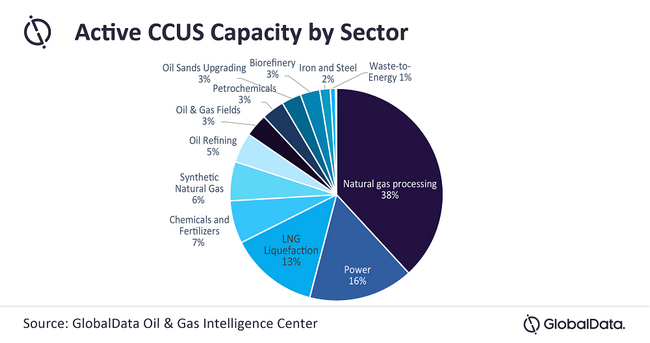

GlobalData’s latest report, ‘Carbon Capture, Utilisation and Storage (CCUS) Strategies in Oil and Gas Industry’, reveals that existing CCUS capacity is concentrated at natural gas processing plants due to the use of captured CO2 in Enhanced Oil Recovery (EOR) activities within the upstream segment of oil and gas. By 2030, all the largest CCUS sectors shown are expected to grow, but none faster than the power sector, which will become the largest user of CCUS capacity. Several oil & gas majors are already collaborating on CCUS projects in the power sector, demonstrating that these companies are beginning to diversify their revenue streams.

Miles Weinstein, Energy Transition Analyst at GlobalData, comments: “Many oil and gas companies developed CCUS knowhow by way of EOR projects simply to boost production, long before they were considering cutting emissions. Today, that knowledge has new value, as oil and gas companies have begun selling their CCUS knowledge in the form of technical advisory services or in developing their own emission reduction projects. Additionally, there is evidence that CCUS projects could generate large amounts of revenue through the growing carbon offset market. For example, Occidental Petroleum believes it could bring in more than $1.5 billion, more than its chemicals business makes today.”

Some of the most active companies GlobalData has identified in the CCUS sector are ExxonMobil, INEOS, TotalEnergies, Occidental Petroleum, Equinor, Shell, and Chevron. Some of these companies, like Exxon, have actively used CCUS technologies for EOR for several decades. Many likely see CCUS as a route to maintain oil and gas production while reducing emissions. While specific strategies vary by company, certain themes emerge. For example, a number of the aforementioned companies support carbon pricing as part of a stable regulatory regime surrounding decarbonization, and already set an internal, company-wide price on carbon for investment and planning purposes. By any measure, CCUS capacity will have to ramp up quickly before 2050 in order to see an impact on emissions reduction.

Weinstein explains: “While CCUS capacity is growing, existing capacity accounts for just 0.15% of total energy-related carbon emissions. According to new planned and announced capacity, this would increase to just 0.8% by 2030. CCUS remains an expensive technology to build or retrofit onto existing facilities, and widespread commercialization will require continued cost reductions. Fortunately, recent R&D efforts have been successful at improving capture technologies at low cost.”

Many large CCUS projects are found at industrial hubs and ports, where carbon can be captured from multiple facilities and fed into a shared transportation network for storage or utilization, leading to lower infrastructure costs. This collaborative approach leads to new partnerships between oil and gas companies, as well as companies in other sectors such as chemicals, power, or heavy industry, all working on the same project.

Weinstein adds: “The burgeoning CCUS sector serves as an example of how the oil and gas sector is beginning to be disrupted from the traditional model, despite serving as one of the least disruptive methods of emissions reduction because it maintains existing revenue streams and infrastructure. Thus, oil and gas companies have a vested interest in the commercialization and widespread use of this technology, as it serves as a bulwark to bigger changes.”

Comments provided by Miles Weinstein, Energy Transition Analyst at GlobalData

Information taken from the GlobalData report: CCUS Strategies in Oil and Gas

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors. PR15500