Displaying items by tag: globaldata

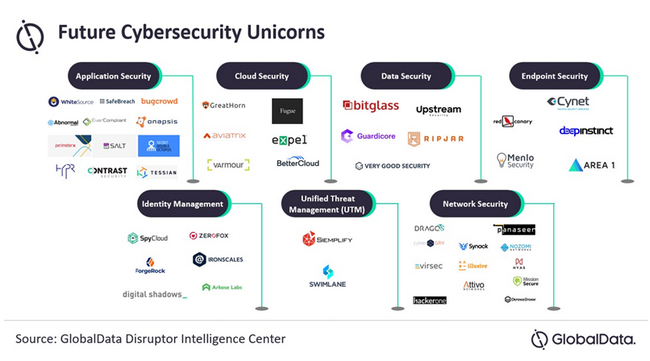

GlobalData predicts future cybersecurity unicorns

Right from the network and data security to identity management and unified threat management (UTM), startups are offering cybersecurity solutions to identify vulnerabilities, thwart attacks, and secure networks. Against this backdrop, the Unicorn Prediction Model of GlobalData, a leading data and analytics company, has released a list of 50 cybersecurity startups that have the potential to become unicorns (>US$1bn).

Apoorva Bajaj, Practice Head of Financial Markets at GlobalData, says: “As we are entering the Code War era, where every digital device, no matter how small, can be ‘weaponized’ and cyberattacks are proliferating globally, investors are investing heavily to back cybersecurity startups. At the same time, the COVID-19 pandemic has offered tailwinds to the industry, as firms embraced a remote work paradigm with more applications and data stored in the cloud, a flurry of new threats is likely to emerge, making cybersecurity investment a necessity.”

GlobalData’s latest report, ‘Future Cybersecurity Unicorns – 18 August 2021’, reveals that in Q2 2021, the industry reported an investment of over US$8.1bn, spanning 209 deals globally. The report also highlights a spike in venture capital (VC) investments in cybersecurity startups in Q2 2021, majorly driven by startups like Transmit Security, Trulioo, and Forter raising funding in the range of US$300m to US$550m. In Q2 2021, North America accounted for over 58% deal volume followed by Europe (17%).

Some of the cybersecurity startups in GlobalData's list of potential unicorns include BetterCloud, Guardicore, Deep Instinct, and Swimlane.

BetterCloud, a US-based SaaS Management Platform, enables IT professionals to discover, manage and secure the growing stack of SaaS applications in the digital workplace. The company recently launched BetterCloud Discover, a new centralized platform that gives enterprises insights into SaaS adoption, and visibility into full scope of sanctioned and unsanctioned applications within its multi-SaaS environment.

Guardicore, a startup offering cloud security solutions, is focused on delivering more effective ways to protect critical applications from compromise through visibility, micro-segmentation, and real-time threat detection and response.

Deep Instinct, a US-based cybersecurity solution provider, is leveraging deep learning and cybersecurity technologies. Recently, the company added new features and capabilities in its prevention-first solution, including increased resilience against adversarial machine learning attacks, credential theft protection, and malicious behavior reporting.

Swimlane, a cybersecurity automation solutions provider, assists organizations in handling all security operation (SecOps) requirements, including prioritizing alerts, orchestrating tools, and automating the remediation of threats. Recently, the company raised US$40m to accelerate partnerships and alliances, expand R&D, and enable further global expansion.

Mr. Bajaj concludes: “Increase in VC deals coupled with substantial growth in patents granted, along with positive news sentiments and growing mentions of cybersecurity in public company filings indicate that this technology is of considerable interest to both VCs and corporates. The COVID-19 pandemic is providing tailwinds to this industry, as companies are embracing remote work model. With cloud-based backup becoming the order of choice to save applications and data, a range of new online threats is likely to emerge, which will make investment in cybersecurity a necessity.”

- Quotes are provided by Apoorva Bajaj, Practice Head of Financial Markets at GlobalData

- The information is based on GlobalData’s Disruptor Intelligence Center

- Based on GlobalData’s Startup Scorecard ranking of 10,000 top startups, 126 Cybersecurity startups globally are shortlisted, of which 50 Cybersecurity startups are predicted to become future unicorns based on GlobalData’s proprietary Machine Learning Model.

- GlobalData’s Startup Scorecard ranks startups relatively using quantifiable data on three pillars: Investments, Innovation and Market Presence to ensure that it is objective and can be comparatively measured across different sectors and themes

- This press release was written using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

About GlobalData’s Disruptor IC

GlobalData’s Disruptor decodes emerging tech-enabled opportunities with must-have information on promising start-ups, technology led innovations, latest sector trends, strategic partnerships, consumer insights, and venture capital portfolio investments among others.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

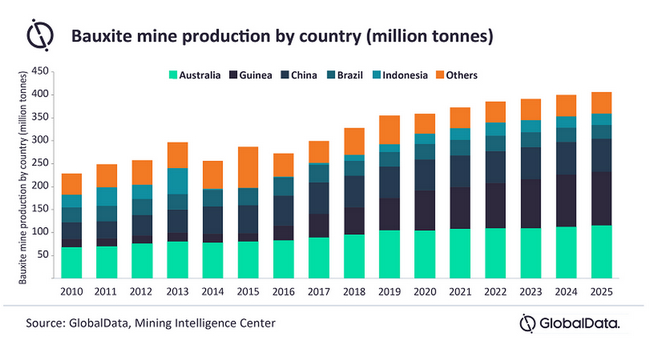

Global bauxite production to grow by 3.8% in 2021, supported by rising output from Australia and Guinea, says GlobalData

After rising by an estimated 1.2% in 2020 to 359.2Mt, global bauxite production is forecast by GlobalData to increase by 3.8% in 2021 to reach 372.8Mt. The leading data and analytics company notes that increased output from mines in Australia (+4.1%) and Guinea (+3.6%), as well as production from mines elsewhere returning to their pre-COVID levels, will be the key contributors.

Vinneth Bajaj, Associate Project Manager at GlobalData, comments: “Over the forecast period (2021-2025), global bauxite production is expected to grow at a compound annual growth rate (CAGR) of 2.2% to reach 406.7kt by 2025. Australia (+1.6%) and Guinea (+6.5%) will maintain a steady supply growth, supported by a series of upcoming projects. Together, they account for eight of the 17 planned bauxite projects, tracked by GlobalData, which have the potential to commence production by 2025.”

In Australia, bauxite production growth will be supported by the recommencement of Metro Mining’s Bauxite Hills mine, where operations were halted due to the wet season. The mine is expected to produce around 4Mt of bauxite in 2021. Further, the formal commitment of the stage 2 expansion of the mine to a capacity of 6Mt, which is part of the company’s long-term development plan, will be dependent on the global market conditions.

Bajaj continues: “In Guinea, the Boffa mine, which began operations in January 2020, is expected to gradually reach its full capacity during the second half of 2021. The mine is expected to produce up to 9Mt of bauxite in 2021, compared with 7Mt in 2020. Earlier in 2021, operations began at the Garafiri project which has over 300Mt of bauxite reserves. The project has an initial production capacity of 3Mt, which will be expanded up to 8Mt.”

In late July 2021, China Railway Construction Corporation (CRCC) announced completion of the construction of a railway line from Boffa to Boke, which will now increase the single trip freight volume to 10kt, up from 5kt earlier, as part of the first phase of the Boke developement project. Phases 2 and 3 include exploitation of bauxite resources in the new mining areas of Santou II and Houda and development of an alumina refinery in the Boke special economic zone. Overall, this will play a crucial role in establishing Guinea as an export nation.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.

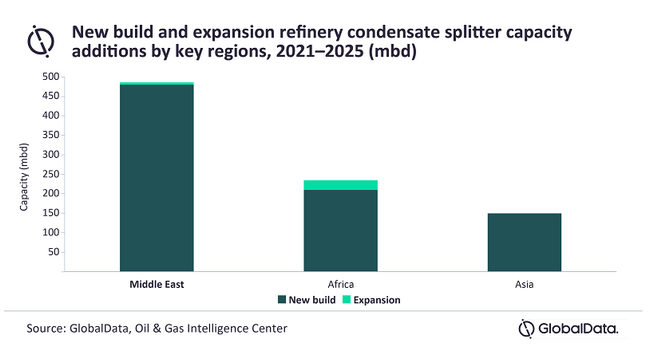

Middle East to spearhead global refinery condensate splitter capacity additions by 2025, says GlobalData

The Middle East is expected to register the highest refinery condensate splitter capacity additions globally between 2021 and 2025, contributing more than half of the total capacity additions by 2025, says GlobalData, a leading data and analytics company.

GlobalData’s report, ‘Global Refinery Condensate Splitter Units Outlook to 2025’, reveals that the Middle East is likely to witness total condensate splitter unit capacity additions of 486 thousand barrels per day (mbd) by 2025, mostly through new build refineries.

Teja Pappoppula, Oil and Gas Analyst at GlobalData, comments: “Iran is the sole contributor to the Middle East’s condensate splitter unit capacity additions as it continues to process gas condensate produced from the giant South Pars field. Among the new build refinery projects in the country, the planned Siraf refinery in Iran is likely to add a capacity of 360 mbd in 2025. The refinery will process gas condensate mainly to produce gasoline and petrochemical feedstock.”

GlobalData identifies Africa as the second highest contributor, accounting for around 27% of the total additions by 2025. Forcados and Ohaji are two refineries in Nigeria that are contributing 100 mbd of capacity each in the region and both are expected to become operational in 2023.

Asia ranks third globally, contributing around 7% of global condensate splitter unit capacity additions during the outlook period. Malaysia accounts for total capacity additions in the region, with 150 mbd of capacity expected to be added by 2025 from the new build Pengerang II project.

- Comments provided by Teja Pappoppula, Oil & Gas Analyst at GlobalData

- Information based on GlobalData’s report: ‘Global Refinery Condensate Splitter Units Outlook to 2025 – Capacity and Capital Expenditure Outlook with Details of All Operating and Planned Condensate Splitter Units’

Announced/Planned: Denotes only new build assets that are in different stages of development and have not started commercial operations.

- A new build project that has not received relevant/ required approvals to develop/build the project is considered as Announced.

- A new build project that has received relevant/ required approvals from the national government/ energy ministry/ regulatory authority/ local environmental authority/ port authority/local government, etc to develop/build the project is considered as Planned.

This report was built using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis, and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.

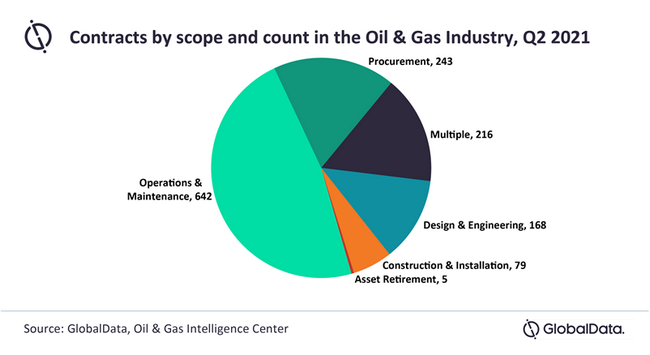

Global oil and gas contracts activity in Q2 2021 declined by 7%, says GlobalData

Oil and gas contract activity declined following the relatively stable activity in Q1 2021, with the industry recording a seven percent decrease in the number of contracts and a significant decrease in disclosed contract value in Q2 2021, according to GlobalData, a leading data and analytics company.

The latest report by GlobalData, ‘Q2 2021 Global Oil & Gas Industry Contracts Review’, notes that the number of oil and gas contracts declined from 1,453 in Q1 2021 to 1,353 contracts in Q2 2021. The value of these contracts also decreased to $27.6bn in Q2 from US$46.4bn in Q1, wherein the significant difference maker was Chiyoda and Technip Energies’ US$12.2bn contract for North Field East LNG which was signed in Q1 2021.

Pritam Kad, Oil & Gas Analyst at GlobalData, comments: “The decline in the number of contracts in Q2 2021 looks temporary and will begin to recover, as the industry foresees an improvement in contracts activity with business outlook, crude oil prices and COVID-19 restrictions now easing.”

Operation and Maintenance (O&M) recorded 47% of the total contracts in Q2 2021, followed by procurement scope with 18%, and contracts with multiple scopes, such as construction, design and engineering, installation, O&M, and procurement, which accounted for 16%.

The notable contracts include Saipem and Daewoo Shipbuilding & Marine Engineering (DSME) joint venture, as well as Keppel Shipyard’s contracts from Petrobras for the construction of Buzios VIII (P-79) and Buzios VII (P-78) FPSO for deployment on the Buzios field. Brazil, and McDermott International and Sinopec International Petroleum Service consortium’s US$2bn future Engineering, Procurement, Construction, and Commissioning (EPCC) contract from Total for the EPCC services for Tilenga development in the Lake Albert Basin, Republic of Uganda.

- Quotes provided by Pritam Kad, Oil & Gas Analyst at GlobalData

- Data taken from GlobalData’s Q2 2021 Global Oil & Gas Industry Contracts Review

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

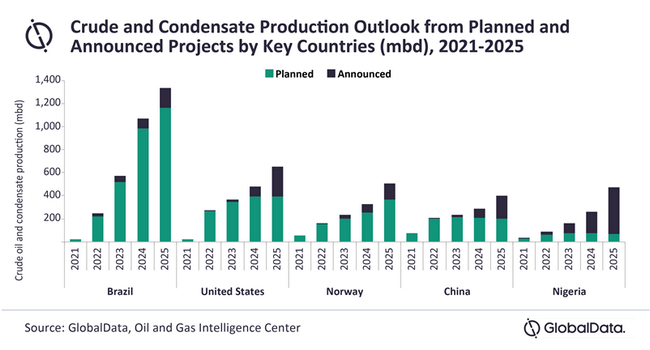

Brazil leads global offshore crude and condensate production from upcoming projects in 2025, says GlobalData

Brazil alone is expected to contribute around 23% or 1.3 million barrels per day (mmbd) of global crude oil and condensate production in 2025 from key offshore planned and announced projects (new-build projects) that are expected to start operations between 2021 to 2025, according to GlobalData, a leading data and analytics company.

The company’s report, ‘Global Offshore Upstream Development Outlook, 2021–2025’, reveals that 1.16 mmbd of crude and condensate production in Brazil in 2025 is expected from planned projects with identified development plans, while 169 thousand barrels per day (mbd) is expected from early-stage announced projects that are undergoing conceptual studies and are expected to get approval for development. A total of 29 crude oil projects are expected to start operations in the country during 2021-2025. Of these, Bacalhau, Buzios V (Franco), and Lula Oeste are some of the key projects that are expected to collectively contribute about 44% of the country’s crude and condensate production in 2025.

Effuah Alleyne, Senior Oil & Gas Analyst at GlobalData, comments: “While Saudi Arabia dominates liquids production globally, mostly from already producing projects, Brazil leads crude and condensate production from upcoming/new projects. Brazil’s prolific pre-salt layer in the Santos Basin has produced a strong portfolio of offshore projects operated mainly by Petróleo Brasileiro S.A. (Petrobras), the main national oil company in the country. These projects have shown robust economics, such as development breakeven oil prices averaging US$40 per barrel and have significantly contributed to South America’s trend of surpassing North America’s offshore production by 2023.”

GlobalData identifies the US as the second highest country globally with 655 mbd of crude production in 2025 or about 11% of the total global offshore crude and condensate production in the year. Norway follows with crude production of 508 mbd from planned and announced offshore projects in 2025.

Among the companies, Petrobras, China National Offshore Oil Corp, and Equinor ASA lead globally with the highest offshore crude and condensate production of 768 mbd, 371 mbd and 331 mbd, respectively, in 2025 from planned and announced projects.

- Comments provided by Effuah Alleyne, Oil & Gas Analyst at GlobalData

- Information based on GlobalData’s report: ‘Global Offshore Upstream Development Outlook, 2021–2025’.

- Announced/Planned: Denotes only new-build assets that are in different stages of development and have not started commercial operations

- Planned: Denotes greenfield projects that have received final investment decision (FID) from equity-holding companies to develop/build/construct it.

- Announced: Denotes projects that are undergoing conceptual studies/pre-FEED or moving into FEED/FDP or are likely to target FID

- This report was built using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis, and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.

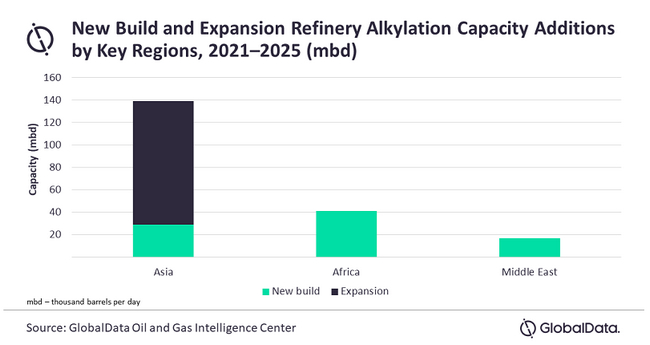

Asia to spearhead global refinery alkylation capacity additions by 2025, says GlobalData

Asia is expected to register the highest refinery alkylation capacity additions globally between 2021 and 2025, contributing about 61% of the total capacity additions by 2025, says GlobalData, a leading data and analytics company.

GlobalData’s report, ‘Global Refinery Alkylation Units Outlook to 2025 – Capacity and Capital Expenditure Outlook with Details of All Operating and Planned Alkylation Units’, reveals that Asia is likely to witness a total alkylation unit capacity additions of 138 thousand barrels per day (mbd) by 2025. Of this, 29 mbd of capacity would be from new-build refineries while the rest of the capacity is from expansion of the existing refineries.

Teja Pappoppula, Oil and Gas Analyst at GlobalData, comments: “Together, China and India account for 82% of the alkylation unit capacity additions in Asia by 2025. The Vadinar refinery in India is the largest upcoming expansion project in Asia with 32 mbd of capacity expected to be added in 2024. Among the new-build refinery projects, the planned Gulei refinery in China is likely to add a capacity of 10 mbd in 2022.”

GlobalData identifies Africa as the second highest contributor to the global alkylation unit capacity additions accounting for about 18% of the total additions by 2025. The planned Lagos I refinery in Nigeria is one of the highest contributors in the region with 20 mbd of capacity expected to become operational in 2022.

Both the Middle East and North America rank third with almost equal contribution of about 7% each to the global alkylation unit capacity during the outlook period 2021–2025. In the Middle East, the planned Al-Zour refinery in Kuwait is the highest contributor in the region with 9 mbd of capacity expected to become operational in 2021. In the North America, the planned Dos Bocas refinery in Mexico is the only contributor in the region with 10 mbd of capacity expected to become operational in 2023.

- Comments provided by Teja Pappoppula, Oil & Gas Analyst at GlobalData

- Information based on GlobalData’s report: ‘Global Refinery Alkylation Units Outlook to 2025 – Capacity and Capital Expenditure Outlook with Details of All Operating and Planned Alkylation Units’

- Announced/Planned: Denotes only new build assets that are in different stages of development and have not started commercial operations.

- A new build project that has not received relevant/ required approvals to develop/build the project is considered as Announced.

- A new build project that has received relevant/ required approvals from the national government/ energy ministry/ regulatory authority/ local environmental authority/ port authority/local government, etc to develop/build the project is considered as Planned.

- This report was built using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis, and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.

Aggressive oil exploration needed in Colombia to avoid high imported gas prices and fracking, says GlobalData

Colombia needs to pursue a much more aggressive oil exploration strategy in order to avoid highly contested fracking activities or an increase in gas prices as a result of importing, according to GlobalData. The leading data and analytics company notes that the country has seen no large discoveries in the last five years, and its crude oil and natural gas output is projected to decline by more than 282,000 barrels of oil equivalent per day (boed) in the next five years. This amount is enough to provide electricity for more than 130,000 homes during a whole year.

Svetlana Doh, Upstream Oil & Gas Analyst at GlobalData, comments: “Colombia is about to see a major deficit in oil that will make the sore topic of fracking more pressing. The country’s shale resources have huge potential, likely exceeding conventional reserves by far. If no discoveries are found soon, people will face the very real decision between a rise in oil prices and protecting the environment.”

Svetlana Doh, Upstream Oil & Gas Analyst at GlobalData, comments: “Colombia is about to see a major deficit in oil that will make the sore topic of fracking more pressing. The country’s shale resources have huge potential, likely exceeding conventional reserves by far. If no discoveries are found soon, people will face the very real decision between a rise in oil prices and protecting the environment.”

There is currently only one announced project in Colombia, which is expected to come online by 2024.

Doh continues: “The Aruchara project is ongoing but its peak production rate is less than 2,000 barrels per day (bd), which is just 0.7% of the production required to keep Colombia’s overall oil and gas supply constant. There are also 90 discoveries that haven’t yet been moved to full development, but the size of the discovered accumulations is not significant and none of them have proved commerciality. Significant and urgent investment in exploration is needed to revive the industry.”

Colombia is estimated to possess significant unconventional resources. At full development, these could help to mitigate the steep decline of mature fields. Indeed, by some estimates, prospective unconventional reserves are two to five times higher than the country’s conventional reserves. However, horizontal drilling and fracking has been an arguable topic in Colombia, and many activist organizations speak strongly against it due to its risk in harming environment and health consequences. In 2018, the Colombian State Council (CdE) introduced a moratorium on any commercial development of shale resources in the country. Currently, only investigative pilot projects (PPIIs) are allowed, and just for the purpose of collecting information on project feasibility and potential damage to environment. In other words, no real development is yet occurring for recovering this resource.

Further, there are currently two lawsuits filed against commercial horizontal drilling and fracking, with another lawsuit filed in July 2020 and specifically targeting PPII guidelines. The government still needs to figure out how to address this opposition and move forward with unconventional drilling.

Doh adds: “All these events are more relevant when considering that Colombia is facing a steeply declining production from natural gas fields, which is forecasted to drop by more than 53% from 1,170 million cubic feet per day (mmcfd) in 2020 to less than 540mmcfd in 2025. Natural gas is the second largest energy source in Colombia. In case no new gas sources are found, the country will have to boost its gas import, which could subsequently raise end user gas prices by more than 50%. Indeed, for Colombia to maintain its energy security in future, a more aggressive exploration program is needed in the frontier areas, like offshore fields and unconventional drilling.”

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

US shale producers remain disciplined with production and capital guidance despite high oil prices, says GlobalData

The speed at which new rigs are put to new developments is considerably less than in previous price cycles. Most US shale producers are being conservative in their production and capital guidance, as priorities remain around protecting balance sheets and generating free cash flow. For many operators, this has led to a drawdown of drilled but uncompleted (DUC) inventory wells in the past six months, to reduce capital expenditure while maintaining production levels, says GlobalData, a leading data and analytics company.

Steven Ho, Upstream Oil & Gas Analyst at GlobalData, comments: “Uncertainty around the pace of economic recovery in some regions due to the Delta variant, and OPEC+’s decision to gradually increase output throughout 2021, is expected to restrict oil price. However, at least a third of US unconventional production is protected against a drop in price due to producers hedging strategies that are in place for the remainder of 2021. At the same time, this means that some operators are not able to benefit whenever there is a higher-than-expected spot price, as their hedging effectively puts a cap on the maximum price they can fetch.”

US domestic production is currently averaging around 11,000 mbd, accounting for at least 74% of the input into refineries. Net import volume remains relatively stable, averaging at 2,900 mbd in 2021 compared to 2,800 mbd in 2020, but remain lower than the pre-pandemic level of 3,850 mbd in 2019. This is mainly due to a build-up of petroleum products stock inventory that has been used to meet some of the increase in demand.

Ho continues: “All in all, the demand for crude oil has been steadily growing during 2021, signalling the recovery of the US economy. The vaccination efforts have definitely translated into a higher traveling activity in the US, as gasoline has been the main driver in oil demand. Over the past six months, supply for gasoline is a little over 8,700 mbd, representing a growth of 7% over the average of 8,100 mbd in 2020. Nonetheless, there is still uncertainty on the pace of the oil demand recovery and on the stability of oil price.”

Throughout the pandemic, US shale producers have behaved rather conservatively with respect to production levels and, more importantly, they have not reacted too quickly to the increase in oil price. Operators are utilizing their DUCs inventory to maintain production level, as well as protecting capital spending as their preferred strategy. As a result, the number of rigs in operation has not reacted as strongly to the price rally, as in other past instances of a price recovery. Shale producers also recognize the volatility in the oil and gas market and are encouraged by investors to hedge their production. This will protect them against a downside risk, while also capping the maximum price at which they sell their production.

Ho adds: “US shale appears to be finding a way to remain resilient and prepared for whenever oil demand requires more crude oil from unconventional developments. Operators will now need to assume a lower price scenario and favor operating in a cost-efficient manner. They also must address concerns around sustaining the generation of free cash flow, keep implementing optimal hedging strategies, reduce debt levels, as well as meeting their carbon reduction targets. Moreover, there is an expectation for increased consolidation across the shale sector where bigger companies can acquire smaller operators, which now are generally healthier in their balance sheet, and can increase the competitiveness of larger companies.”

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

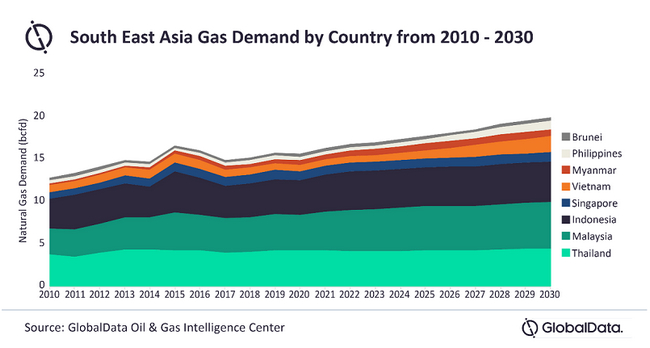

Southeast Asia to increasingly rely on LNG imports through 2030, says GlobalData

Despite being a net exporter of liquefied natural gas (LNG), Southeast Asia is set to increasingly rely on imported LNG through 2030 to meet the growing demand and support the waning domestic supplies, says GlobalData, a leading data and analytics company.

Southeast Asia represents a key growth region for natural gas over the next decade as populations and economies continue to grow and several countries look to gas for meeting the ever-growing power demand. Despite the region being a net exporter of gas supported mainly by major gas producers Malaysia and Indonesia, strong demand growth could outpace the regional supply by the end of the decade.

Daniel Rogers, Senior Oil and Gas Analyst at GlobalData, comments: “In the gas and LNG outlook for the region, both Thailand and the Philippines’ gas supply-demand gaps are expected to widen as steady demand growth is met by the declining domestic supply. Both countries will look to the LNG market to fill the gap where domestic production or pipeline imports are unable to, through additional LNG regasification capacity. There is over 3 trillion cubic feet (tcf) of regasification capacity in the pipeline, approximately 2 tcf of planned and 1 tcf of announced capacity across these two countries that could be online by 2030, this compares to just 0.5 tcf of capacity currently active.”

In 2020, Thailand and Singapore imported record LNG volumes, and Myanmar imported its first ever LNG cargo despite the pandemic. In Thailand, LNG imports are likely to become increasingly important for the country as both domestic supply and imports from Myanmar face natural decline while the demand growth from these two countries continues to rise. Even till 2030, Singapore is expected to remain heavily dependent upon gas as it represents almost all the country’s power generation. Singapore’s LNG imports jumped 20% last year and with the piped gas supply contracts expiring over the near term, LNG imports will be vital for supporting a gas hungry power mix.

Mr Rogers concludes: “On the supply side, Malaysia and Indonesia have a project pipeline that will help boost production over the near term and just under 4 mtpa of increased LNG liquefaction capacity in Indonesia will increasingly be used to supply its domestic market. However, Brunei, Vietnam and Myanmar risk facing domestic supply declines over the forecast period unless they can progress their currently challenged, undeveloped gas projects. Progress of such projects will be pivotal for their supply outlooks.

“LNG exporters will be watching South East Asia closely as new entrants to the LNG import market emerge and a build out of regasification capacity will provide opportunity in the form of new buyers and more volumes directed to the region.”

- Quotes provided by Daniel Rogers, Senior Oil and Gas Analyst at GlobalData

- This press release was written using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

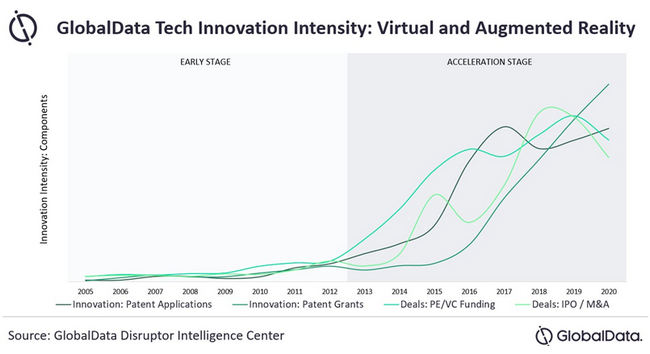

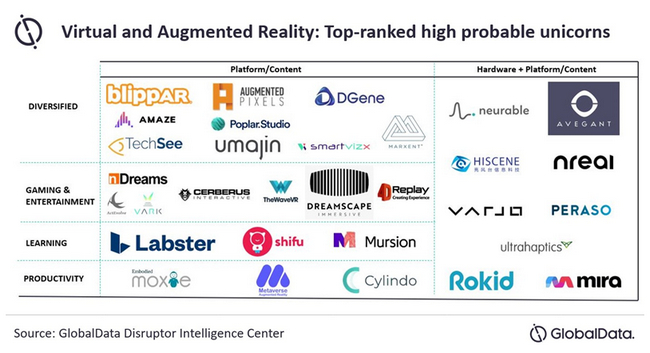

GlobalData identifies virtual and augmented reality as innovation-led disruptive tech, picks top startups

Rapid acceleration in innovation in virtual and augmented reality (VAR) space is quickly bridging the digital and physical worlds to deliver tangible and significant applications across diverse industries. GlobalData, a leading data and analytics company, identifies VAR as a leading innovation driven technology and has picked top startups in VAR space with high probability of becoming unicorns.

GlobalData’s Technology Innovation Intensity (TII) tracks the pace of innovation in a technology using key alternative datasets such as deals and patents and as per the framework VAR ranks in top-15 innovation-led technologies set to have meaningful impact across industries.

Adarsh Jain, Director of Financial Markets at GlobalData, says: “Virtual and augmented reality has seen a rapid surge in patent grants over the last 2-3 years with elevated interest from venture capital investors. These are solid innovation fundamentals for future evolution and adoption of the technology, and GlobalData sees this reflecting in the VAR ecosystem bringing out innovative products at a rapid pace.”

For instance, almost a fifth of Facebook employees are working on AR / VR tech, and CEO Mark Zuckerberg is betting AR/VR to be the next major computing and social media platform to enable ‘being present with people in digital space’. Terming it metaverse, Facebook is looking to enable people to hangout, play games with friends, work, create and more within this digital realm and planning to launch its first smart glass from Ray-Ban in partnership with EssilorLuxottica to enable such activities.

GlobalData's Startup Scorecard uses a proprietary scoring mechanism to rank each startup on innovation, investments, and market presence while GlobalData’s AI-based unicorn prediction model helps predict potential start-ups 3-5 years in advance.

Some of the VAR start-ups in GlobalData’s list of potential unicorns include Avegant, Blippar.com and Varjo.

California-based Avegant counts Intel Capital and Applied Ventures among its investors. With a strong patent portfolio covering its light field technology, the company is already in the process of scaling up its next generation, immersive, screenless video headsets in diverse fields ranging from product design and engineering to entertainment and healthcare.

UK-based Blippar.com has made a niche for itself in developing AR content for consumer retail industry. Backed by Qualcomm Ventures, BlippAR has developed key intellectual property in building full stack AR applications for both web and mobile environments. Its proprietary BlippBuilder platform is used by leading marketing campaign designers.

Varjo, a Finland-based start-up, recently introduced reality cloud platform bringing the users closer to ‘teleportation’ experience. Counting Volvo and EQT Ventures among its investors, the company has built a strong tech portfolio of over 100 patents. Already testing the European market for its high-end VR headsets, the company is inching closer towards making Sci-fi dream come true.

Mr Jain concludes: “Falling hardware and software costs, ubiquity of mobile devices and continued innovation will enable VAR to have transformative impact across sectors in the future and GlobalData therefore believes that companies need to embrace VAR as the technology of the future”

Please login to GlobalData’s webinar on 05 August 2021 to learn more.

- Quotes are provided by Adarsh Jain, Director of Financial Markets at GlobalData

- The information is based on GlobalData’s Disruptor Intelligence Center

- This press release was written using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

About GlobalData’s Disruptor IC

GlobalData’s Disruptor decodes emerging tech-enabled opportunities with must-have information on promising start-ups, technology led innovations, latest sector trends, strategic partnerships, consumer insights, and venture capital portfolio investments among others.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.