Uncategorised (70)

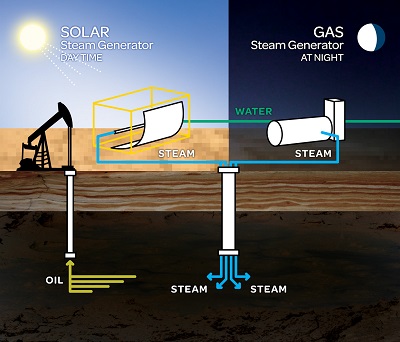

New systems for enhanced oil recovery (EOR) are constantly being developed. One of the more interesting approaches is GlassPoint's solar steam generators can replace natural gas in generating the steam injected into oil wells to boost recovery, reducing CO2 emissions by up to 80%.

Supporters for the technology include Petroleum Development Oman, which has selected the technology for a solar thermal EOR demonstration project, while Shell has become an investor in Glasspoint.

Traditionally natural gas is burned to generate steam for injection into reservoirs. The steam heats thick oil, helping it to flow more freely and boost production.

Gas, however, is a valuable resource in many oil producing countries, especially in the Gulf states of the Middle East where it is needed to generate power and desalinate water.

The gas saved can then be used where it is needed the most to generate electricity for industrial applications or exported as liquefied natural gas.

But conventional solar thermal technologies can be costly; the rows of mirrors which collect sunlight are made of expensive, heavy steel, and require substantial, concrete structures that anchor them to the ground against strong winds. Dust and debris collect on the mirrors, which makes them less efficient and call for frequent, labour-intensive cleaning.

California-based Glasspoint's founders engineers Rod MacGregor and Pete von Behrens came up with the idea of putting the entire solar field in a glasshouse.

“By enclosing the troughs in an agricultural-grade glasshouse, we can use low-weight, low-cost materials to reduce the capital cost of the field by more than half,” says MacGregor.

The troughs are so light that they hang from the glass ceiling, while an automated robot cleans the glasshouse roof, reducing operations and maintenance costs and conserving water.

Independent energy company Berry Petroleum of California recognised the technology’s potential and invited GlassPoint to install a pilot plant at a 100-year-old oil field in California. The plant started up in 2011 and was the world’s first commercial solar EOR project.

This was followed by a second project, 27 times bigger than the first, for Petroleum Development Oman (PDO), the largest oil producer in Oman in which Shell has a 34% interest. The pilot plant started production in December 2012 and was officially commissioned in February 2013.

Between February and July it replaced around 400,000 m³ of gas, saving 800 tonnes of CO2 emissions that would otherwise have been emitted from the gas fired steam generators. To date, the project produces 10% more steam than originally expected.

“When Shell makes an investment in a small company like ours, potential customers take note,” said MacGregor. “Shell’s investment and interest legitimises the technology and helps put our company on the map.”

Given that getting renewable energy and energy-from-waste projects off the ground can be such as lengthy and painstaking process the growth in the number of UK projects starts is impressive.

Construction market analysts Glenigan has reported a stream of renewable energy and waste treatment projects moving forward during the second half of 2013.

While last year the level of renewable energy starts were roughly flat on 2012, Glenigan now reports "strong growth across a range of projects to generate energy-from-waste and maximise recycling have begun on site.

"Renewable energy will be the main source of growth in 2014, following a 40% increase in planning approvals this year," said Glenigan's Construction Prospects for 2014 report.

Arguably the biggest play in the space is at Drax, which has officially opened a new systems to receive, store and distribute biomass for its first converted biomass unit, which has been running since the start of April, with the second planned for next year and the third in 2016.

Drax operates six generating units, which together deliver 7-8% of the UK's power requirement.

Sembcorp Industries on 24 Dec announced 'financial close' for its new 49MW energy-from-waste project in the UK - indicating that it had secured full financial backing for the £250-million scheme, due on-stream in 2016.

The project involves the development of a facility for the Merseyside and Halton Waste Partnership at the company’s Wilton International industrial site in Teesside, UK.

Air Products says its advanced gasification plant, in Billingham, near Stockton, is on schedule to begin operations in 2014, Redhall Group has reported.

Redhall Engineering based at Middlesbrough is delivering a £3m contract to make and install pipework at the UK’s first energy-from-waste power station to use plasma technology, which generates energy by burning domestic and commercial waste destined for landfill.

Elsewhere, Advanced Plasma Power has gained planning permission from Birmingham City Council for a proposed 6MW commercial Gasplasma waste-to-energy plant in Tyseley, Birmingham.

MWH Treatment is to design, build and maintain a £47.8m biomass gasification facility for Birmingham Bio-Power Ltd. Due on-stream in early 2016, the 10.3MW plant in Tyseley, Birmingham, will burn around 67ktpa of wood waste sourced under a long-term contract with a local supplier.

The gasification technology is provided by Nexterra Systems of Canada. MWH will run and maintain the plant under a five-year contract. The project is expected to create 100 construction and 19 full time jobs.

Meanwhile, Hitachi Zozen Inova Ltd is currently seeking contractors to tender for a £40m energy-from-waste facility at the Rivenhall Site, Coggesshall Road in Braintree, Essex. Tenders are due to be returned on 31 Jan 2014.

In Spotland, SSE has the go-ahead for its proposed 600MW Coire Glas pumped storage hydroelectric scheme at Loch Lochy. The £800m project would extract, store and release energy to and from the electricity transmission system, and have energy storage capacity of up to 30GWh.

Work has started on the £81m Evermore Renewable Energy biomass renewable power plant in Northern Ireland, the Green Investment Bank said 10 Dec. The 15.8 MWe CHP plant is project is due for start-up by summer 2015, and will be built and operated by BWSC.

Finally, the much-delayed start-up of Cynar's plastics-to-diesel plant at Sita's Avonmouth site, near Bristol is likely to happen in 2014, according to a Sita spokesman.

The Avonmouth plant was scheduled to be fully commissioned over a year ago, but has yet to come on-stream. This is now expected to happen during 2014, according to a spokesman for SITA UK - a key partner in the project.

The plant, he stated, is going through "a gentle commissioning and fine-tuning phase before we hold an official opening - but I would expect this to be in the next few months."

Cynar's collaboration with Sita envisages the establishment of several sites using its process technology across the UK. Rockwell Automation is also partnering Cynar, which already has a plant up and running in Portlaoise in the Republic of Ireland and is establishing another unit in Spain.

Given that getting renewable energy and energy-from-waste projects off the ground can be such as lengthy and painstaking process the growth in the number of UK projects starts is impressive.

Air Products says its advanced gasification plant, in Billingham, near Stockton, is on schedule to begin operations in 2014, Redhall Group has reported. Redhall Engineering based at Middlesbrough is delivering a £3m contract to make and install pipework at the UK’s first energy-from-waste power station to use plasma technology, which generates energy by burning domestic and commercial waste destined for landfill.

Elsewhere, Advanced Plasma Power has gained planning permission from Birmingham City Council for a proposed 6MW commercial Gasplasma waste-to-energy plant in Tyseley, Birmingham.

MWH Treatment is to design, build and maintain a £47.8m biomass gasification facility for Birmingham Bio-Power Ltd. Due on-stream in early 2016, the 10.3MW plant in Tyseley, Birmingham, will burn around 67ktpa of wood waste sourced under a long-term contract with a local supplier.

In Spotland, SSE has the go-ahead for its proposed 600MW Coire Glas pumped storage hydroelectric scheme at Loch Lochy. The £800m project would extract, store and release energy to and from the electricity transmission system, and have energy storage capacity of up to 30GWh.

Work has started on the £81m Evermore Renewable Energy biomass renewable power plant in Northern Ireland, the Green Investment Bank said 10 Dec. The 15.8 MWe CHP plant is project is due for start-up by summer 2015, and will be built and operated by BWSC.

The plant, he stated, is going through "a gentle commissioning and fine-tuning phase before we hold an official opening - but I would expect this to be in the next few months."

Edited speech by energy minister Michael Fallon MP to the EDF supply chain conference on 9 Dec at the ExCel Conference Centre, London:

These are exciting times, particularly in respect of the UK’s new nuclear programme. Several key milestones in the Hinkley Point C programme have already been reached ... and while state-aid approval from the Commission and third-party financing is still to be secured - the significant progress made has cleared the path for starting the construction of the first new nuclear reactor to be built in the UK for 30yrs.

We have now reached the stage at which EDF Group, with their partners, cannot continue this project alone. This is the point at which the supply chain, working collaboratively, must engage and begin the process of turning the Hinkley Point C approved designs and plans into a physical reality. This is the point at which your expertise, skills and determination will take this project from the drawing board to producing 3.2GW of low-carbon power annually for the UK for over 60 years.

Hinkley represents the first of a whole fleet that will hopefully be deployed in the medium-term so it is essential to take a long-term perspective of the supply chain opportunities that new nuclear brings.

Building safe and secure nuclear power stations that generate carbon-free electricity - and doing it to time and budget - while also enhancing the UK’s industrial and economic landscape, are crucial components underpinning the broad public support for new nuclear power in the UK.

A significant failure in this regard would be to the detriment of our wider programme. The stakes are high and the challenges significant, but the opportunities are great.

It is worth taking a moment to remind ourselves on why new nuclear is important. It is without doubt, a safe, proven low carbon technology that can contribute to the UK’s future energy security, helping to ensure a diverse mix of technology and fuel sources over the long term.

And it will do this in a way that doesn’t pump harmful carbon emissions into the atmosphere.

In addition to helping the UK meet its energy needs and its environmental commitments, new nuclear power stations will create outstanding opportunities for the UK economy both via investment and jobs at Hinkley Point C and the follow-on developments.

Civil nuclear is a key growth industry that provides highly skilled jobs. The full 16GW of new build capacity planned by industry could support an estimated 29,000-41,000 jobs across the nuclear supply chain at the peak of construction activity, with industry investment equating to around £60 billion.

So I have explained why both the new nuclear programme and Hinkley Point C specifically is important to the UK, but why should it be important to you as a potential supplier. Why should you get involved? What’s in it for you?

Why be involved?

Involvement in this project gives you the opportunity take advantage of the entire UK new build programme right from the start. It gives you the opportunity to benefit from Billions of pounds worth of manufacturing contracts for Hinkley Point C alone.

It gives you the opportunity to be identified as part of the ‘baseline’ supply chain for all EPR reactors that may be built in the UK in the future and the opportunity to develop partnerships, both with other UK firms or with overseas companies to expand your offerings and provide new and innovative solutions.

It gives you the opportunity to be recognised as a suitably qualified nuclear supplier, with recent UK new build experience, to nuclear developers with an investment programme for the UK that equates to around 60 Billion pounds in total.

Finally, it gives you the opportunity to use the skills, expertise and partnerships developed on this project to strengthen your ability to look beyond the UK market and access the staggering 1.5 trillion dollars worth of new build investment in new nuclear build predicted globally by the World Nuclear Association by 2025, across circa 30 countries.

Your being here today is evidence of your desire to be involved in this project and beyond. I know that it has taken longer than we all would have wanted to in order to get to this stage.

But we are now at a stage where practical action is essential to ensure that that firms stand ready and able to access the new build opportunities when they arise and win the contracts on the strengths of their bids. In order to do that, companies need confidence that the new build programme will indeed take place.

The recent agreement announced between EdF Group and the UK Government is a clear demonstration to the supply chain of our commitment to new build. In addition, companies need much more information to be disseminated across the supply chain on the nature of the work packages involved, the estimated schedules and timeframe’s associated with projects. There also needs to be strong partnership working between the developers, their top tier contractors and the rest of the supply chain. That is why events like this one today, are so important.

I’ve explained some of the benefits I believe you will gain by being involved in this project and what can be reasonably be expected of the developers and the top tier contractors but what will be expected of you in return? No company can expect to win such a prize without effort as you are all very aware.

So what will be expected of the Hinkley Point C supply chain?

Firstly, and most importantly, we expect the highest standards of safety and compliance to all requirements of the UKs independent nuclear regulator. The British people quite rightly expect, and trust, that the new nuclear programme will not compromise the very high safety record that has built up over decades of safe nuclear operations and decommissioning activity across the UK. The ongoing acceptability of nuclear power in the UK and beyond depends upon this.

You have an obligation to ensure that nothing you do in any of your operations has a detrimental effect on the trust that has been placed on you and the UK nuclear industry.

Secondly, all suppliers must comply with the proscribed codes and standards for this design. I know that these will be the subject of further discussion during the event today, as EDF Energy and their partners provide more detail of these, so I will not dwell on these.

Thirdly, all suppliers must be cost competitive. No company should expect to win a contract on this project unless they are cost competitive. No company can expect to win a contract just because they are British, or indeed, just because they may be part of an established developer supply chain.

This is important not just for the developer but also for the UK taxpayer who as the right to expect, as promised in the 2008 white paper, that nuclear power is cost competitive with other forms of low carbon energy.

These three requirements are simple to explain but, I know are not always simple to achieve so, quite rightly the government will be right alongside you in helping you to achieve these.

The British government is committed to providing the supply chain with the support needed to ensure they have both the capability and capacity to take full benefit from the opportunities I outlined earlier. The newly formed Nuclear Industry Council has been created to ensure both Government and Industry do just that.

Specifically for the manufacturing supply chain this support comes, to name just three of many groups, from;

•The Nuclear Advanced Manufacturing Research Centre to help both develop the capability of individual firms and to ensure, via use of our world class R & D facility in Rotherham, that we can develop the advanced manufacturing techniques required to support both this and the next generation of reactor designs.

•The Manufacturing Advisory Service to provide tailored business support in order to help you, the manufacturer, streamline your processes, reduce waste, become more energy efficient and generally improve and grow your businesses

•And the National Skills Academy for Nuclear Manufacturing to both identify and develop the highly skilled resource that is the bedrock of the manufacturing supply chain.

Members of these groups are here today, along with many others who will be providing much more information on all the support available to you.

In addition to these I am delighted to announce that early in 2014, up to £13 million will be made available jointly by the UK’s Innovation Agency, the Technology Strategy Board, the Department of Energy and Climate Change and the Nuclear Decommissioning Authority to help UK-based businesses take advantage of the opportunities that arise from the UK’s new nuclear programme.

This is part of a drive to grow a robust and sustainable UK supply chain by developing innovative products and services for the nuclear sector. The initiative will focus on key technology areas such as construction, manufacturing, operation, maintenance and decommissioning & waste. This funding competition will open on the 17th March 2014.

Finally I want to strongly welcome the earlier announcement made by Humphrey Cadoux-Hudson on the launch of the Nuclear Supply Chain SME Partnership. Developing strong partnerships and regular, shared communications across the supply chain will be critical to the successful delivery of the UK’s Nuclear programme and I believe that this group will be a vital component in achieving this.

The Hinkley Point C project is a fantastic opportunity for you to become part of the firm foundations on which the UK’s new nuclear renaissance will be built.

Name: Details to follow

Owner/Operator: (Details to follow)

Location: (Details to follow)

Cost: (Details to follow)

Schedule: (Details to follow)

Engineering: (Details to follow)

Suppliers: (Details to follow)

GSK's manufacturing site in Irvine, Scotland is widely regarded as a leading example of what can be achieved in the areas of low-carbon manufacturing and overall sustainability.

The largest energy and water consumer of the pharmaceuticals group’s 80 manufacturing sites worldwide, GSK Irvine is well on the way to reaching its ambitious goals of coming off the national electricity grid, and zero carbon from energy by 2020.

To achieve these targets, the Scottish operation has, since 2009, developed a sustainability programme involving the engagement of all staff and the appointment of 'energy 'Kaizens' to research and instigate energy-saving initiatives.

"The site produces two main pharmaceutical products, 6APA and 'clav' blends," explains Mark Dunn, sustainable manufacturing manager at GSK Irvine. "These operations are both targeted within our sustainability programme, via focus teams within each production area and for the services supplied from the utilities and wastewater treatment areas."

Around 50 projects have so far been implemented under the sustainability programme, which has delivered a 24% reduction in carbon from energy over the last five years.

Many of these involved rigorous measuring and monitoring to identify improvements that have already led to the implementation of steam traps, IE3 motors, heat recovery, HVAC, LEDs and combined heat and power (CHP).

Currently £20 million is being invested in two major projects: wind turbines to supply a projected 12% of electricity needs; and anaerobic digestion of fermentation waste that will produce methane to power a CHP plant and take wastewater treatment off-grid.

According to Dunn, the AD project is currently under construction and will be commissioned from January 2014.

"Commissioning to full output takes several months so full environmental and energy benefits will be delivered from the second quarter of 2014," he said.

Looking further ahead, Dunn said new targets for GSK Irvine range from "improvements in efficiency of well-established technologies to identifying local sustainable fuel sources that can be applied to energy generation on site.

"This extends to assessing the carbon footprint of alternative techniques for conversion of our raw material into the final product."

Though he declined to identify specific process technologies under review, the sustainable manufacturing leader concluded: "GSK Irvine is continuing to review all potential opportunities towards meeting its energy and carbon goals by 2020."

This caused serious problems on the methanisation line that prevented stable operation of the facility.

Operators found huge levels of sediment in the digesters and floating layers, clogging of pipelines, while high losses of the digestible organics in the pre-treatment stage led to poor biogas and residue yields.

Another concern is that some overseas firms are providing new ‘biogas packages’ with, for example, CHP engines that sometimes don’t meet UK regulations.

Among those tracking such developments is Charlotte Morton, chief executive, Anaerobic Digestion and Biogas Association (ADBA), which works to support the AD industry and its customers, and the development of best practice.

“All AD plants are different, and the equipment requirements can vary hugely depending on the feedstock that will be processed and how biogas and digestate will be used," said Morton. “It is therefore vitally important that plant developers are well informed, and ask the right questions of their equipment suppliers.”

Process Industry Suppliers - Suppliers from around the world, with a detailed description about their products and services

ABB Process Automation

ABB Process AutomationABB UK provides customers with products and solutions for instrumentation, automation and optimisation of industrial processes.

View full company profile

Atlas Copco UK

Atlas Copco UKAtlas Copco UK is part of the Atlas Copco industrial group, a major global supplier of compressors, expanders and air treatment systems, construction and mining equipment, power tools and assembly systems.

View full company profile

Landia

LandiaManufacturer of heavy-duty chopper pumps, submersible mixers, jet-aerators and advanced process units.

View full company profile

Mitsubishi Electric is a major global supplier of electrical and electronic equipment used in communications, consumer electronics, industrial technology, energy and transportation.

View full company profile

Fuel cell energy developer AFC Energy has selected GB Innomech to develop automated manufacturing equipment to assemble fuel cell stacks for the company’s EU-backed Power Up programme.

The work includes the development of automated equipment to dismantle stacks at the end of their working life, allowing key components and materials to be recycled and reused.

The appointment is being made with the support of a four-year, £4.9 m EU development grant that will enable AFC Energy and the Power Up consortium to develop and install commercial-scale energy generation plants using hydrogen as a fuel source.

One of the first clean energy plants will be located at Air Products’ industrial gas processing facility at Stade, northern Germany.

The first of two KORE systems is due to be installed in 2014 and the plant will generate a total of 500kW electrical output when fully operational.

MG, Novozymes plan world's first biomass-to-glycols plant in China

Administrator

M&G Chemicals is to build a 1,000ktpa facility to produce glycols from biomass in China. Due on-stream in 2015, the biorefinery is expected to be the first of its type in the world.

The plant, in Anhui province, close to Fuyang in eastern China, is to be established through a JV between M&G Chemicals and Guozhen Group Co. of China. The Chinese partner is to provide 1,000ktpa of wheat straw and corn stover for the facility.

The plant will use Beta Renewables’ PROESA technology, with Novozymes to supply the enzyme technology for biomass conversion on an exclusive basis over a 15-year period. Novozymes will also provide financial support of $35 million to support M&G's project.

PI Match interview with Simon Coombs, business development director at Capula Ltd – an independent system integrator, specialising in solutions that combine automation control, real-time IT with electrical and instrumentation, and focused on the energy and utilities market sectors across the UK:

PIM How is the automation project pipeline flowing at the moment?

SC Overall, we continue to see automation projects coming to a close and a growing pipeline of opportunities across each of our market sectors. This is especially true for small and medium sized projects. However, we see some of our larger projects being delayed in approvals and it is momentum with these large projects that makes all the difference of course.

PIM Which sections of the markets served by Capula are most active, and why?

SC All our markets have on-going work on the back of increased investment in energy and infrastructure over the last few years within the UK. However, we measure activity in terms of new projects being let.

Power generation and renewable energy sectors are extremely active at the moment with a large increase in opportunities as clients' confidence increase with improved government incentives (to address future energy security of supply and carbon reduction targets), improved access to project finance, streamlined planning, etc.

Other markets are at a low in the delivery cycle. For example, the water industry coming towards the end of the current investment cycle (called AMP5) with new projects focusing on planning and conceptual design for the next investment period starting in a couple of years. This requires a different type of resource and structure to support these projects.

Similarly, the nuclear sector has delays in starting legacy improvement projects and also new build of the next generation of nuclear power stations. If you are involved in providing feasibility studies and conceptual design, however, there is plenty of advisory work for automation specialists.

PIM What other drivers or barriers are influencing project approvals at the moment?

SC Clients' business performance continues to be kept under close scrutiny. Therefore, even if our clients have strong balance sheets and good access to funding, they are not starting projects unless there is a clear and compelling business case. Obsolescence upgrades and interesting demonstrator projects that historically were done simply for engineering reasons are tending not to get approved.

The response in the marketplace is to ensure that each of our projects will lead to a clear benefit to the our clients' businesses with defined approaches to minimising delivery and operation risk. Of course, this is increasing the importance of effective automation control and real-time IT solutions that can really make a difference for our clients. It is also increasing the importance of having domain expertise and proven credentials - in addition to a good price, of course!

PIM Any other factors emerging that might impact on these markets going forward?

SC The general trend for automation and drives over recent years has been to procure standardised products from the main, global vendors in order to benefit from their on-going funding in research and development and access to common, standard solutions across diverse markets.

Our clients are under increasing pressure to reduce their costs, both for capital or operational expenditure. They are pushing this pressure down their supply chains and are therefore looking for innovative approaches that can decrease the delivery and the whole-life costs of solutions.

However, this is conflicting with the trend by large, global automation vendors to steadily increase the price of their products year on year in response to increasing energy, materials and manufacturing costs.

As system integrators we find ourselves in the squeezed middle between these conflicting pressures. Therefore, a future trend might be the re-emergence of bespoke, innovative products from smaller, nimble vendors that can provide more cost effective, albeit less standardised solutions, for our clients.

Thank you

More...

Landia is a major manufacturer of: heavy-duty chopper pumps, submersible mixers, jet-aerators and advanced process units.

The company's products are in worldwide service in: Wastewater treatment plants, biogas plants, in agricultural farms, in the food and beverage industry and in the process industry.

Founded in 1933, the company has 80 years of experience in manufacturing high quality pumping and mixing equipment. Learn more about 'Landia - Pumping and Mixing Solutions - made in Denmark' on www.landia.co.uk

Landia Ltd

Waymills Industrial Estate Whitchurch,

St. Shropshire SY13 1TT

United Kingdom

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Phone: +44 (0) 194 8661 200

Telefax: +44 (0) 194 8661 201

http://www.landia.co.uk

Recent coverage on PI Match

Landia units for new Chinese WWT facility - Read more

Keep biogas simple, urges Danish AD boss - Read more

Landia pumping station for Grocontinental - Read more

Warning for biogas system buyers - Read more

Selected press releases:

Landia GreenLine: Highly efficient low-energy mixers - Read more

Landia’s pumps pass acid-test at grass pelletting plant - Read more

Rags and thick sludges can’t halt Landia’s mixers - Read more

Hook Norton Brewery choose Landia’s pumps - Read more

Landia aerators eliminate sewage odour problem - Read more

Howard Road

Eaton Socon

St Neots

Cambridgeshire PE19 8EU UK

ABB retains leading distributed control system market share worldwide for 2012 - Read more

ABB Q3: Solid performance across the business - Read more

ABB’s new reaction monitor provides fast and flexible device for laboratories and pilot plants - Read more

Fast-track packaged substation project for Total Lindsey Oil Refinery - Read more

Contact

Mitsubishi Electric Europe B.V.

Travellers Lane

Hatfield, Herts

AL10 8XB.

UK

t: +44 (0) 1707 276100

f: +44 (0) 1707 278693.

- UK technology helps Nissui produce sauces five times faster - Read more

Mitsubishi Electric's FX3S creates new PLC category (Read more)

A tri-company project representing the best of British innovation and application expertise has won the Robotics & Automation category of the Food Processing Awards 2013 - part of the annual Appetite for Engineering event for the food manufacturing industry

The winning project - decided by votes from readers of Food Processing magazine - combines multi-axis robotics, 3D vision technology and development and integration expertise to automate baked-product decoration.

The three companies involved were robot technology provider Mitsubishi Electric, Scorpion Vision which provided a 3D machine vision system and Quasar Automation, which provides solutions for challenging applications in food manufacturing.

Explaining the winning baked-product icing system, Jeremy Shinton of Mitsubishi said the non-uniform shape of many food products makes applying decoration, such as piped icing, very much a manual task.

“Mitsubishi Electric and Scorpion Vision have teamed up with Quasar Automation to create a decorative depositing method that takes into account the irregular shapes but maintains the depositor at a constant height above the work piece," said Shinton.

"With such accuracy the decorative icing is applied in a repeatable way. This allows the optimum time for the icing to set, often a critical issue in real-world production processes,” he added.