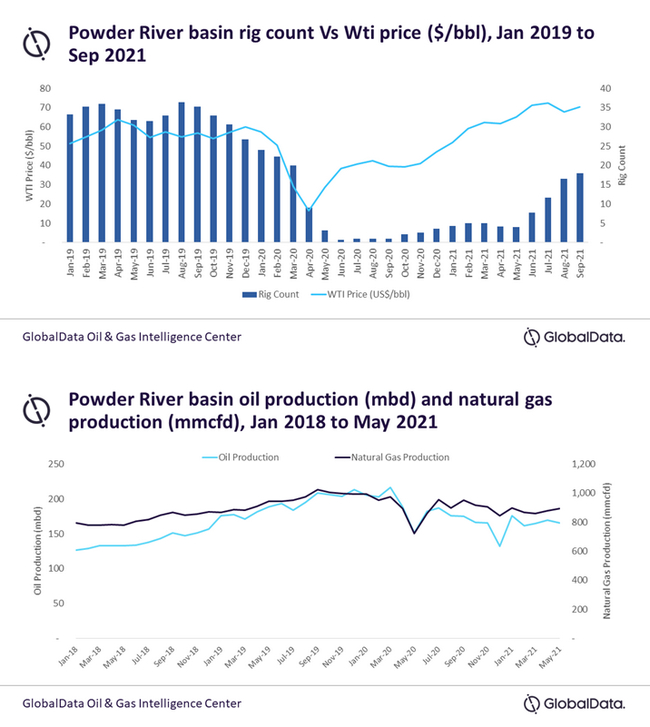

Rig count in the Powder River basin, situated in Wyoming and Montana, has increased almost four-fold from four in April 2021 to 17 in August 2021, according to GlobalData. The leading data and analytics company notes, considering the recent sustained upswing in US crude prices, production of both crude oil and natural gas in the basin is expected to grow by a respective 28% and 13% by December 2022*.

Svetlana Doh, Oil & Gas Analyst at GlobalData, comments: “Unlike other basins in the area, Powder River’s production nearly rebounded to pre-pandemic levels only four months after the onset of the pandemic. Production then kept a downward trend, at an average of -1% a month, but June 2021 saw an uptick in the number of rigs. This could signify a mitigation or even reversal of the trend.”

According to GlobalData’s latest report, ‘Powder River Basin Shale in the US, 2021 – Oil and Gas Shale Market Analysis and Outlook to 2025’, production in the Powder River basin somewhat recovered in June 2020 to 182 mbd of crude oil and 957 mmcfd of natural gas. However, levels stayed below this throughout H1 2021.

Doh continued: “Drilling activity in the region was very slow. Even when WTI price rose to $52 per bbl in January 2021, rig count was still only around four - 83% less than the number of rigs observed in February 2020 before the COVID-19 pandemic hit the US.”

The Powder River basin accounts for less than 5% of the country’s overall crude oil production in the country.

Doh adds: “Most players in the region have acreages elsewhere. For example, Occidental Petroleum, which holds the highest leaseholds of 400,000 net acres in Powder River, also owns significant positions across the Denver-Julesburg and Permian basins. The slow growth of drilling activities in Powder River could be because operators instead focused on high-return assets such as the Permian basin.

“Once oil price stabilized to over $70 per bbl in June 2021, there was a rapid boost in the number of rigs, with an average 50% increase in rig count each month - until August, when the total rig count reached 17 for the whole basin.”

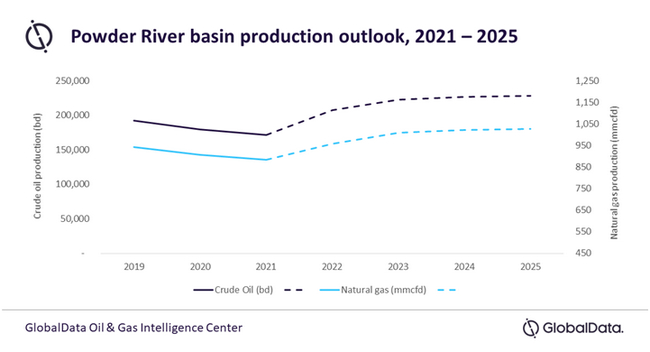

Looking forward, production of both crude oil and natural gas in Powder River is projected to see an upward trend to 2025. Indeed, natural gas production in the basin is expected to grow by 4% during 2021-25 to reach 1,026 mmcfd in 2025. On the other hand, crude oil production is expected to see steeper growth, at a compound annual growth rate (CAGR) of 7%.

Doh commented: “Both crude oil and natural gas are expected to exceed pre-pandemic production levels by 2022.”

* Compared to August 2021 levels

- Quotes provided by Svetlana Doh, Oil & Gas Analyst at GlobalData

- Data taken from GlobalData’s report: Permian Basin in the US, 2021 – Oil and Gas Shale Market Analysis and Outlook to 2025

- The report provides a comprehensive review of the DJ Basin shale play, comprising the effects of COVID -19 outbreak on operations in the Basin. The report also forecasts the future trend of oil and gas production supported by investment plans by major operators in the Basin.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.