Ian Melin-Jones

Top 25 Largest Metals and Mining Companies Market Cap Soars by 80% YoY

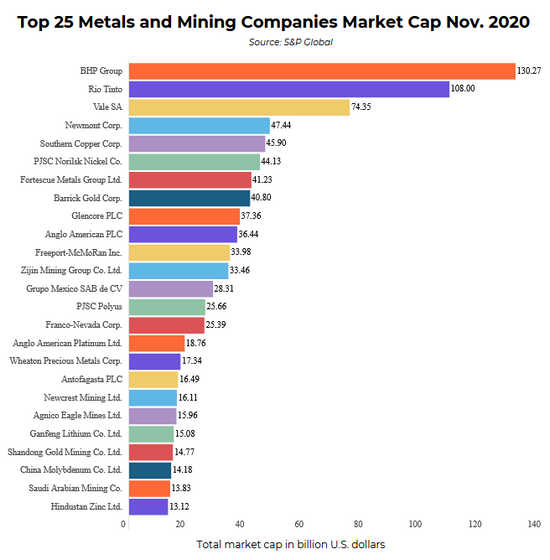

The top companies in the mining and metals industry have weathered the pandemic storm relatively well. The top 25 metals and mining companies were worth a cumulative $908.36 billion on December 1, 2020.

According to the research data analyzed and published by Comprar Acciones, they gained a median of 2.7% month-over-month (MoM) in November 2020 and 80% year-over-year (YoY).

Moreover, based on a report by Mining.com, the top 50 companies in mining gained a collective $80.2 billion in market cap during Q3 2020. Their collective market cap went from $989.83 billion in Q4 2020 to $1.028 trillion at the end of Q3 2020.

90% of Best Performers in Mining in Q3 2020 Are Gold Producers

BHP Group was the largest company in the industry by market cap at the end of November 2020. It had a market cap of $130.27 billion, up by 12.6% MoM but down by 2.5% YoY.

Rio Tinot was second with $108 billion, up by 11% MoM and 13.7% YoY. Vale came in a distant third with $74.35 billion, up by 28.8% MoM and 56.1% YoY.

Glencore at #9 was the highest MoM gainer, jumping by 35.9% to $37.36 billion. Zijin Mining Group at #12 was second with a 35.6% MoM increase to $33.46 billion. It was also the second highest YoY gainer, surging 174.1% since November 2019. On the other hand, Ganfeng Lithium Co. at #21 had the highest YoY gain, jumping 196.2% to $15.08 billion.

From March 2020 to the end of November, the top 50 mining companies added $327.56 billion to their collective market value. That was a significant improvement from their collective loss of $288.47 billion in Q1 2020.

Around 90% of the top performers are gold producers. Gold producers and precious metal royalty companies accounted for 33% of the value of the top 50 companies. Since the Q1 2020 slump, they contributed $150 billion to the total gains in the mining industry.

Honda Motor shows 80% growth in influencer conversations on Twitter over last six months, reveals GlobalData

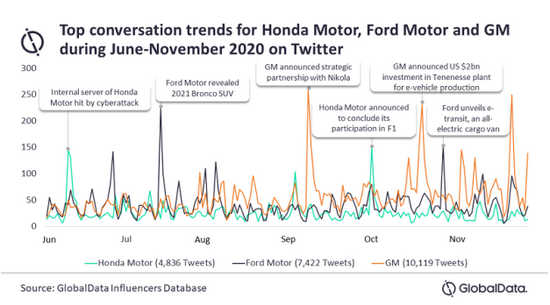

Honda Motor Co., Inc (Honda Motor) witnessed an 80% jump in influencer conversations on Twitter during June-November 2020 over the previous six months, according to GlobalData, a leading data and analytics company.

Smitarani Tripathy, Influencer Analyst at GlobalData, comments: “In October, a dramatic conversation spike among influencers around Honda Motor was noticed when the company announced to exit the Formula One World Championship at the end of the 2021 season. The move forms part of the company’s aim to reach its carbon neutral goal by 2050 with focus on developing technologies for fuel cell vehicles and electric vehicles.

“Another major spike for Honda was noticed in June, when the company’s internal server was hit by cyberattack, which brought production, sales and development across its global plants to halt.”

General Motors Company (GM) has emerged as the most mentioned automotive company among influencer discussions on Twitter compared to its peers Ford Motor Company (Ford Motor) and Honda Motor during the period.

An analysis of GlobalData’s influencer platforms revealed that, in terms of percentage growth during June-November 2020 over the previous six months, GM recorded 50% growth in influencer conversations while Ford saw 40% growth only.

A major spike of discussions around GM on influencer platform was noticed in September, when the company agreed to acquire 11% ownership stake in electric vehicle startup Nikola Corporation (Nikola) and build Nikola’s Badger hydrogen fuel cell and electric pickup truck. Another spike was seen in October, when GM announced to invest US$2bn in its Tenenesse plant for electric vehicle production. However, the deal was called off in November.

Likewise, there was a sharp rise in influencer conversations around Ford Motor in October, led by the company’s E-Transit, an all-electric version of delivery van, planned to be launched in November 2020 as part of the company’s push for electrification.

- Quotes are provided by Smitarani Tripathy, Influencer Analyst at GlobalData

- Information is based on GlobalData’s Honda Motor Co., Inc, Ford Motor Company and General Motors Company Influencer Platforms, which track most relevant activity of the industry influencers on Twitter

- This press release was written using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

About GlobalData’s Influencer Platform

The Influencer Platform is a part of GlobalData’s Disruptor Database that decodes emerging tech-enabled opportunities with must-have information on promising start-ups, technology led innovations, latest sector trends, consumer insights, and venture capital portfolio investments. It helps monitor competitor strategies, predict emerging trends, monetize disruptive innovation, decode smart money, mine thought leadership, and capture digital consumers.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make timelier and better business decisions thanks to GlobalData’s unique data, expert analysis, and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

Metso Outotec delivers flotation technology to GTK’s pilot plant

Metso Outotec will deliver new, smart flotation cells to GTK Mintec’s pilot plant in Outokumpu, Finland. The delivery consists of approximately 20 pilot flotation machines and additional equipment. GTK Mintec is replacing the flotation cells to modernize and expand its services. The new flotation cells will support the improvement of the monitoring of beneficiation studies and process design.

“GTK and Metso Outotec promote sustainable and competitive mining technologies. We are pleased that GTK chose Metso Outotec’s leading edge flotation technology for their test facilities,” says Stephan Kirsch, President of Metso Outotec’s Minerals business area.

Metso Outotec flotation cells

Metso Outotec flotation cells

“The test plant and laboratory in Outokumpu offer mining customers a comprehensive service package. The whole production process needed for a mineral deposit can be tested there on the scale required by the research problem. Through the flotation investment, our domestic and international customers can use state-of-the-art technology in research related to battery minerals and circular economy materials, for example,” says the head of the Circular Economy Solutions unit Jouko Nieminen from the Geological Survey of Finland (GTK).

Further information:

Paul Sohlberg, Vice President, Separation business line, Metso Outotec, tel. +358 40 481 3737, email: paul.sohlberg(at)mogroup.com

Metso Outotec is a frontrunner in sustainable technologies, end-to-end solutions and services for the aggregates, minerals processing, metals refining and recycling industries globally. By improving our customers’ energy and water efficiency, increasing their productivity, and reducing environmental risks with our product and process expertise, we are the partner for positive change.

Headquartered in Helsinki, Finland, Metso Outotec employs over 15,000 people in more than 50 countries and its pro forma sales for 2019 were about EUR 4.1 billion. The company is listed on the Nasdaq Helsinki. mogroup.com, twitter.com/metsooutotec

Pace of economic recovery and demand dynamics to determine Southeast Asian plastics industry growth, says GlobalData

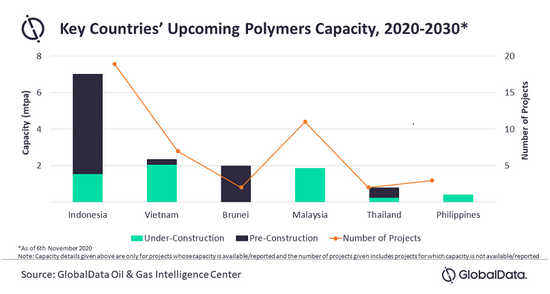

The COVID-19 continues to wreak havoc across the globe causing severe damage to the growth of the global and regional economies. Consequently, the Southeast Asian companies in the plastics industry are forced to downsize their capital expenditure (capex) for 2020 as a measure to sustain during the crisis. They are even compelled to undertake rationalization of certain operational expenditure plans including reduction of non-essential expenses and deferment of certain expansion projects to mitigate the impact of the pandemic. The eventual progress of these projects may depend on the demand dynamics and pace of economic recovery, says GlobalData, a leading data and analytics company.

Dayanand Kharade, Oil and Gas Analyst at GlobalData, comments: “Operators of the petrochemical companies focus on strategic imperatives and reschedule their project timelines accordingly. Companies tend to delay project execution or postpone financial investment decisions (FIDs) wherever possible. FIDs of PT Chandra Asri‘s Cilegon Polyolefin projects have been postponed by a year to 2022 while the start-up of JG Summit Petrochemical’s Batangas polyolefin project has been delayed from Q2 2020 to 2021. These delays, although necessary, could impact the profitability of companies extending the time taken for them to break-even.”

Polymer capacity additions are largely concentrated in Indonesia, targeting the growing domestic demand and to reduce the dependence on imports. Most of the upcoming capacity in Indonesia, Brunei and Thailand are under the initial stages of development that might get delayed given the current economic scenario. However, projects which are in the final stages of development are likely to move ahead, albeit with short-term impact due to the pandemic.

Kharade concludes: “Southeast Asia's polymers demand is expected to decline in 2020, with the weakening demand from segments such as construction, automotive, etc. However, increasing demand from packaging, FMCG, and healthcare segments have helped sustain the growth of the polymers market. With the expected lifting of major lockdowns and improvements in the business activities across the region, the demand for polymers is expected to pick-up during the end of 2020 and likely to maintain the growth patterns from 2021.”

- Quotes provided by Dayanand Kharade, Oil & Gas Analyst at GlobalData

- This press release was written using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.

Alfa Laval launches marine system for reduction of greenhouse gases

Alfa Laval – a world leader in heat transfer, centrifugal separation and fluid handling – has launched a new marine environmental system, Alfa Laval PureCool. The system, in combination with WinGD’s iCER technology, can reduce methane slip from ships’ gas engines which, if released in the atmosphere, has a higher global warming potential than CO2. The new PureCool system is the latest addition to Alfa Laval’s extensive marine environmental product portfolio.

The International Maritime Organization (IMO) has the target of cutting vessel-related greenhouse gas emissions by at least 50 percent by 2050. As the marine industry works towards a future based on non-fossil fuels, Liquid Natural Gas (LNG) is expected to be one of the transition fuels towards decarbonization.

The new Alfa Laval PureCool system, in combination with WinGD’s iCER technology (as mentioned in a press release on June 25, 2020) targets an unaddressed emission source: methane slip, which is the small percentage of unburned methane that escapes through the engine when LNG is used as fuel. Although combusted LNG releases less CO2 than other fossil fuels, the methane has a higher global warming potential than CO2, which makes the unburned fraction a concern. No regulations currently exist for methane slip, but the issue should be addressed if the marine industry is to reach a 50 percent reduction in marine greenhouse gas emissions by 2050.

The new Alfa Laval PureCool system, in combination with WinGD’s iCER technology (as mentioned in a press release on June 25, 2020) targets an unaddressed emission source: methane slip, which is the small percentage of unburned methane that escapes through the engine when LNG is used as fuel. Although combusted LNG releases less CO2 than other fossil fuels, the methane has a higher global warming potential than CO2, which makes the unburned fraction a concern. No regulations currently exist for methane slip, but the issue should be addressed if the marine industry is to reach a 50 percent reduction in marine greenhouse gas emissions by 2050.

“As LNG is an important bridge fuel in the transition to a zero-carbon future we need to mitigate the negative environmental consequences of this fuel as far as possible,” says Sameer Kalra, President of the Marine Division. “Our new Alfa Laval PureCool system not only helps in the reduction of methane slip but also enables fuel savings which makes it a good solution for both our customers and the environment.”

Alfa Laval PureCool is the latest addition to the company’s PureThinking concept introduced more than 15 years ago which. It includes, among several products, key systems like Alfa Laval PureBallast and PureSOx, which enable shipowners to comply with marine regulations.

Did you know that… according to DNV GL, the shipping industry’s fuel mix in 2050 is expected to have switched from being almost entirely oil dominated, to a mix of low- and/or zero-carbon fuels (60 percent) and natural gas (30 percent)?

This is Alfa Laval

Alfa Laval is active in the areas of Energy, Marine, and Food & Water, offering its expertise, products, and service to a wide range of industries in some 100 countries. The company is committed to optimizing processes, creating responsible growth, and driving progress – always going the extra mile to support customers in achieving their business goals and sustainability targets.

Alfa Laval’s innovative technologies are dedicated to purifying, refining, and reusing materials, promoting more responsible use of natural resources. They contribute to improved energy efficiency and heat recovery, better water treatment, and reduced emissions. Thereby, Alfa Laval is not only accelerating success for its customers, but also for people and the planet. Making the world better, every day. It’s all about Advancing better™.

Alfa Laval has 17,500 employees. Annual sales in 2019 were SEK 46.5 billion (approx. EUR 4.4 billion). The company is listed on Nasdaq OMX.

Wave power pioneers raise £850k to bring green power to subsea oil and gas

Wave power specialists Mocean Energy have secured major new investment to accelerate the commercialisation of their ground-breaking wave energy technology.

- Mocean Energy raises over £600k equity plus £250k from Innovate UK

- Plans to advance wave technology and commercialise in oil and gas

- Equity investment from angel syndicate Equity Gap, Scottish Investment Bank and Old College Capital

- Prototype test in Orkney early next year

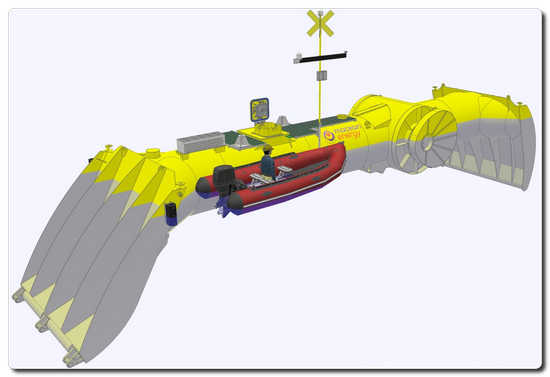

The Edinburgh start-up has raised £612,000 equity seed funding plus £250,000 from Innovate UK to advance the design of their Blue Star wave machine [pictured] and drive its adoption in subsea oil and gas.

Mocean Energy’s funding round has been led by business angel syndicate Equity Gap and includes investment by Old College Capital, the University of Edinburgh’s in-house venture investment fund, and the Scottish Investment Bank, the investment arm of Scottish Enterprise.

The equity funding unlocks a further £250,000 from Innovate UK, the UK’s innovation agency.

“Our goal is to produce a commercially-available wave machine which can deliver low carbon power for tie backs and future fleets of autonomous AUVs [autonomous underwater vehicles],” explains Mocean Energy Managing Director Cameron McNatt.

To do this, McNatt has worked alongside company co-founder Chris Retzler [pictured] to build a 12-strong expert team adopting cutting-edge thinking in using numerical modelling coupled with AI-optimisation to design their state-of-the-art wave machine.

“Blue Star has been created from first principles to operate autonomously in remote locations and deliver green energy for a range of applications – including scientific ocean monitoring, aquaculture, oil and gas, and delivering energy to remote communities.

“We are currently working with firms in the Scottish supply chain to build and deliver our first prototype, which will commence testing at the European Marine Energy Centre in Orkney next year.

“The Innovate UK grant will enable us to advance our engineering design, including a new power take off, moorings and umbilical, and will deliver additional grant support to our project partners Newcastle University’s Electrical Power Research Group and Rosyth-based electronics-specialists Supply Design.

“The equity funding is a tremendous boost and underscores our ambition to deliver a commercial product. As well as supporting our technology development pathway, this will allow us to create two new full-time posts which will bring an increased focus on finding the right kind of industry partners to drive our commercialisation goals. Crucially, it also brings on board three new non-executive board members who bring a wealth of experience to help us deliver our vision,” Cameron says.

Fraser Lusty, Director, Equity Gap said:

“Mocean Energy has an exciting technology backed by some very sound science and ideally placed to help the oil and gas sector decarbonise its operations, with other worldwide applications to follow. This funding allows them to broaden their team and seek well-aligned commercial partners who can bring offshore experience to accelerate their ambitious plans.”

Kerry Sharp, Director of the Scottish Investment Bank said:

“Bold and ambitious low carbon technology companies like Mocean Energy are fundamental to Scotland’s transition to a net-zero emission economy. This latest injection of funding, alongside the significant Innovate UK funding, will allow the team at Mocean to move ever closer to fully commercialising their ground-breaking wave power technology.”

Earlier this year Mocean Energy announced a pilot project with the Oil and Gas Technology Centre (OGTC), oil major Chrysaor and subsea specialists EC-OG and Modus to study the potential to use their Blue Star prototype to power a subsea battery and a remote underwater vehicle.

Last year, Mocean Energy secured £3.3 million from Wave Energy Scotland to build and test a half-scale version of their technology at sea. The device is currently being completed at AJS Fabrication at Cowdenbeath in Fife.

The Scottish Investment Bank

The Scottish Investment Bank (SIB) is the investment arm of Scotland’s national economic development agency, Scottish Enterprise, operating Scotland-wide in partnership with Highlands and Islands Enterprise (HIE) and South of Scotland Enterprise (SoSE). SIB’s activities support Scotland’s SME funding market to ensure businesses with growth and export potential have adequate access to growth capital and loan funding. We help ambitious Scottish companies get the right levels of funding from the right sources at the right time through building relationships with both domestic and international investors.

SIB manages a suite of co-investment funds including the Scottish Co-investment Fund, the Scottish Venture Fund and the Energy Investment Fund on behalf of the Scottish Government. SIB is an investor in Epidarex Capital’s Life Sciences Fund. SIB also administer the Scottish Loan Scheme, with funding secured from the Scottish Government’s Scottish Growth Scheme. SIB are delivering the Early Stage Growth Challenge Fund on behalf of the Scottish Government as part of their response to COVID-19.

SIB also provides funding into LendingCrowd, Scotland’s marketplace lender providing loans to SMEs, and Maven's UK Regional Buy Out Fund (MBO) that offers financial support for management buyouts (MBOs) and helps existing management teams acquire their businesses from their owners so they can continue to flourish. SIB’s team of financial readiness specialists help companies to prepare for new investment and access appropriate finance.

British Battery Manufacturer Reaction to earlier ban on petrol and diesel cars

Today, Boris Johnson revealed his intentions to accelerate the ban on the sale of new petrol and diesel vehicles, bringing it forward by five years to 2030, as part of a £4bn ‘green industrial revolution.’

£1.3bn of investment has also been pledged towards electric vehicle (EV) charging points, as well as grants for EV buyers stretching to £582m to help people make the transition, whilst there is also nearly £500m for battery manufacture.

The government has insisted that it would collaborate with the UK motor industry to aid the mass production of electric vehicles and lithium-ion batteries that power them, but the sector is already struggling to keep up with the surge in demand.

The government has insisted that it would collaborate with the UK motor industry to aid the mass production of electric vehicles and lithium-ion batteries that power them, but the sector is already struggling to keep up with the surge in demand.

This questions whether the country will be able to meet deadlines and have a sufficient supply of electric vehicles in less than 10 years.

To support the expanding electric vehicle market – which will make up 1 in 5 of all car sales by 2026 – the creation of an onshore full-cycle supply chain and return of the investment ecosystem needs to be prioritised.

We have Kevin Brundish, the founder and CEO of the UK’s only full-cycle battery manufacturer AMTE Power, who is available for interview to discuss the new challenges facing the strained sector and what needs to be done in order to hit the new 2030 target.

Kevin Brundish, CEO at AMTE Power comments: “This is obviously fantastic news and accelerates the electrification of cars, which is a significant step in meeting the country’s climate change targets. For businesses like ours, which are targeting the development and supply of innovative battery cell products, this continued government support, which goes alongside financial support packages such as the Faraday Industrial Strategy Challenge Fund and the Automotive Transformation Fund, will help to create the right investment environment for us to grow here in the UK. This accelerated transition to electrification will require an onshore supply chain for the electric vehicle’s most crucial component, the lithium ion battery, the creation and growth of which will also stimulate the wider economy and create much needed jobs. AMTE Power’s own manufacturing expansion plans are very much aligned with this onshore supply chain need.”

About AMTE Power

AMTE Power works with clients and partners to scale new battery cell technologies through to manufacture and supply. AMTE helps in the early stages of development and design for manufacture, and has developed advanced lithium battery cells for a range of end user markets.

AMTE Power have developed alternative chemistries, including a new range of cells aimed to provide UK EV manufacturers with security of supply chain and alternative cell options unavailable from large scale foreign providers.

AMTE Power working in partnership, have also completed the build of the world's first "smart cell" high voltage battery pack. AMTE’s cells show significant technological development over traction battery cells currently available. Offering almost an order of magnitude by providing information and characterisation of battery cells, whilst simultaneously eliminating more than half of a conventional BMS, the smart cell technology has the potential to revolutionise the next generation of automotive EV and HEV battery packs, with significant safety and weight advantages, it is especially attractive in the world of marine and aerospace as well as Electric Vehicles.

AMTE’s battery production facility has a unique cell manufacturing plant in Thurso, Scotland. It is a direct replica of the large-scale cell manufacturing process, supporting prototyping and development of new technology on schedule.

Keliber and Kokkolan Energia confirm agreement on the site of the chemical plant

Keliber and Kokkolan Energia have confirmed a 30-year lease agreement for a 12.5-hectare site of the Keliber chemical plant to be built in the Kokkola Industrial Park.

“We are very pleased with the good cooperation with Kokkolan Energia. We have an excellent construction site in the chemical industrial area with a high level of infrastructure and service offering. The area's focus on the circular economy and safety as well as in port, rail and vehicle traffic will serve our needs excellently,” says Hannu Hautala, CEO of Keliber.

“We are very pleased with the good cooperation with Kokkolan Energia. We have an excellent construction site in the chemical industrial area with a high level of infrastructure and service offering. The area's focus on the circular economy and safety as well as in port, rail and vehicle traffic will serve our needs excellently,” says Hannu Hautala, CEO of Keliber.

“We are pleased that we confirmed the agreement with Keliber. It serves the development of the Kokkola Industrial Park, the entire city of Kokkola and offers to develop forward-looking activities with Keliber. Personally, I see an interesting opportunity to utilize for example waste heat”, says Mikko Rintamäki, CEO of Kokkolan Energia.

The agreement will take effect from January 1, 2021.

More information:

Keliber Oy, CEO Hannu Hautala, tel. +358 40 712 2432

Kokkolan Energia, CEO Mikko Rintamäki, tel. +358 40 558 2289

Keliber Oy

Keliber Oy is a Finnish mining and chemical industry company with an objective of producing battery grade lithium hydroxide for the needs of the international lithium battery market.

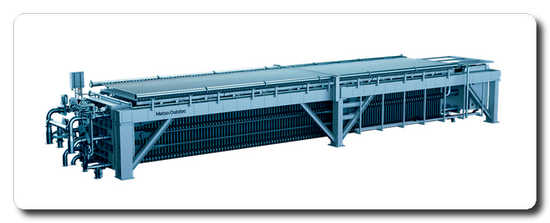

Metso Outotec launches high-capacity Larox ® FFP3716 filter for sustainable tailings filtration

Metso Outotec is introducing a new high-capacity filter for demanding tailings applications. Extending the product family line of the FFP filters, the new Larox® FFP3716 filter comes with compact plate pack design and smart automation, redefining the overall standard in reliability, capacity and safety in tailings filtration. Combined with Metso Outotec’s optimized filtration plant design, the FFP3716 filter offers a reliable and cost-efficient long term solution for tailings management even in challenging environments.

”Responsible usage of water in the mining industry is the primary driver for increasing interest in tailings dewatering. At Metso Outotec, our goal is to provide holistic tailings management solutions by bringing a step change in the way we view, handle, and manage tailings,” says Geoff Foster, Head of tailings filtration a Metso Outotec. ”Backed by proven technology and industrial knowledge, our efficient dewatering solutions help in maximizing water recovery and reuse. The Larox® FFP3716 filter represents the most advanced technology currently available for safe and efficient dewatering.”

FFP3716 filter

FFP3716 filter

High filtration volume with optimum plate pack design

With substantial increase in total filtration volume, the Larox® FFP3716 uses the most optimum plate pack design leading to reduced wear on plate pack and cloth components along with ease operation and spares holding. The new design of the closing and sealing mechanism with individual controlled sealing cylinders ensures squared plate pack at any time, resulting in long lifetime of the pack. The FFP3716 filter has been designed from bottom to top with optimal safety in mind.

Technical features of the Larox FFP3716® filter

- 2000m² filtration area

- 44m³ chamber volume

- Up to 16 bars operating pressure

- Smart hydraulic system

- Readiness for remote production Application support

Find out more about Larox® FFP3716 filter on our website.

Metso Outotec is a frontrunner in sustainable technologies, end-to-end solutions and services for the aggregates, minerals processing, metals refining and recycling industries globally. By improving our customers’ energy and water efficiency, increasing their productivity, and reducing environmental risks with our product and process expertise, we are the partner for positive change.

Headquartered in Helsinki, Finland, Metso Outotec employs over 15,000 people in more than 50 countries and its pro forma sales for 2019 were about EUR 4.1 billion. The company is listed on the Nasdaq Helsinki. mogroup.com

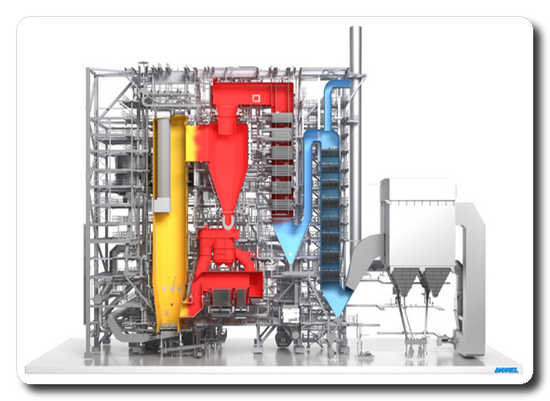

ANDRITZ to supply another high-efficiency PowerFluid circulating fluidized bed boiler with biomass firing in Japan

International technology group ANDRITZ has received an order from Toyo Engineering Corporation, Japan, to deliver a PowerFluid circulating fluidized bed boiler with a flue gas cleaning system. The boiler will be part of a new biomass power plant to be built in Ichihara, Chiba Prefecture, some 30 km southeast of Tokyo. Commercial operations are scheduled to begin in late 2023.

ANDRITZ PowerFluid circulating fluidized bed boiler Photo: ANDRITZ

ANDRITZ PowerFluid circulating fluidized bed boiler Photo: ANDRITZ

The PowerFluid boiler to be supplied by ANDRITZ features low emissions, high efficiency and availability, as well as high fuel flexibility. It forms an essential part of a high-efficiency biomass power plant for supply of green energy to the national grid. The biomass power plant fired with wood pellets and palm kernel shells as main fuels will generate around 75 MWel of power.

This is now the ninth order within three years for supply of an ANDRITZ PowerFluid circulating fluidized bed boiler to the Japanese market. This confirms ANDRITZ’s comprehensive expertise and acknowledged competence in the biomass-fired fluidized bed boiler sector. ANDRITZ is one of the leading global suppliers of power boiler technologies and systems for generating steam and electricity from renewable and fossil fuels, with a large number of very successful references worldwide.

ANDRITZ GROUP

International technology group ANDRITZ offers a broad portfolio of innovative plants, equipment, systems and services for the pulp and paper industry, the hydropower sector, the metals processing and forming industry, pumps, solid/liquid separation in the municipal and industrial sectors, as well as animal feed and biomass pelleting. The global product and service portfolio is rounded off with plants for power generation, recycling, the production of nonwovens and panelboard, as well as automation and digital solutions offered under the brand name of Metris. The publicly listed group today has around 27,800 employees and more than 280 locations in over 40 countries.