The COVID-19 continues to wreak havoc across the globe causing severe damage to the growth of the global and regional economies. Consequently, the Southeast Asian companies in the plastics industry are forced to downsize their capital expenditure (capex) for 2020 as a measure to sustain during the crisis. They are even compelled to undertake rationalization of certain operational expenditure plans including reduction of non-essential expenses and deferment of certain expansion projects to mitigate the impact of the pandemic. The eventual progress of these projects may depend on the demand dynamics and pace of economic recovery, says GlobalData, a leading data and analytics company.

Dayanand Kharade, Oil and Gas Analyst at GlobalData, comments: “Operators of the petrochemical companies focus on strategic imperatives and reschedule their project timelines accordingly. Companies tend to delay project execution or postpone financial investment decisions (FIDs) wherever possible. FIDs of PT Chandra Asri‘s Cilegon Polyolefin projects have been postponed by a year to 2022 while the start-up of JG Summit Petrochemical’s Batangas polyolefin project has been delayed from Q2 2020 to 2021. These delays, although necessary, could impact the profitability of companies extending the time taken for them to break-even.”

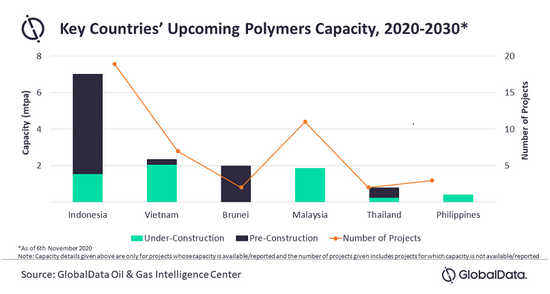

Polymer capacity additions are largely concentrated in Indonesia, targeting the growing domestic demand and to reduce the dependence on imports. Most of the upcoming capacity in Indonesia, Brunei and Thailand are under the initial stages of development that might get delayed given the current economic scenario. However, projects which are in the final stages of development are likely to move ahead, albeit with short-term impact due to the pandemic.

Kharade concludes: “Southeast Asia's polymers demand is expected to decline in 2020, with the weakening demand from segments such as construction, automotive, etc. However, increasing demand from packaging, FMCG, and healthcare segments have helped sustain the growth of the polymers market. With the expected lifting of major lockdowns and improvements in the business activities across the region, the demand for polymers is expected to pick-up during the end of 2020 and likely to maintain the growth patterns from 2021.”

- Quotes provided by Dayanand Kharade, Oil & Gas Analyst at GlobalData

- This press release was written using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.